The SWFL market update for November shows a housing landscape that has quietly shifted from stalemate toward more opportunity. Mortgage spreads have tightened, rates have eased from their peak, inventory is rising, and affordability has improved to its best level in more than two and a half years. That combination is changing the options available to buyers and nudging more homeowners toward listing their homes. In this blog, Mary Bartos of the Bartos Group of Premiere Plus Realty is joined by Cheryl Stokes of New American Funding to discuss the SWFL real estate market in November 2025.

National Trends Shaping Local Decisions

Three national forces explain why the market paused and why momentum is returning. First, affordability pressures kept many prospective buyers on the sidelines while home prices remained near record highs and borrowing costs were elevated. Second, the so called lock-in effect kept sellers stuck: more than 70 percent of mortgaged homeowners hold rates below 5 percent and many were unwilling to give those rates up. Third, broader economic uncertainty—job worries, inflation concerns, and geopolitical noise—made would-be movers cautious.

Even with those constraints, market mechanics are improving. Mortgage spreads moved lower in 2025, helping 30-year fixed rates trend closer to the mid sixes rather than spiking above seven. While the Federal Reserve has signaled that future policy moves are not guaranteed, mortgage rates do not move one-for-one with policy rates. The relationship with Treasury yields and spreads matters too, and the current environment has nudged affordability in a helpful direction.

Why Turnover Has Been Historically Low — and Why It May Change

Turnover has been uncommon: only about 2.8 percent of U.S. homes changed hands in 2025 (28 homes per 1,000). That is well below pre-pandemic normal years when turnover routinely sat in the high 30s and low 40s percent range. The combination of elevated prices, attractive preexisting mortgage rates, and caution explains the freeze.

Now, several pressures are beginning to outweigh the value of that low-rate mortgage. Life events—new jobs, family growth, downsizing, relocation for elder care—are prompting homeowners to act. Analysts report a growing share of sellers are willing to give up low rates to meet personal needs. That shift is important for Southwest Florida because it increases listings and restores choice for buyers.

Affordability Is Improving

Affordability has improved thanks to three converging factors: modestly lower rates, slight price moderation in many markets, and faster wage growth. One measure from mid-September shows 30 percent of median household income is required to cover principal and interest on the average-priced home, down from more than 32 percent earlier in the summer and a peak above 35 percent in late 2023.

That change translates into real monthly savings. For many buyers, the difference between qualifying and not qualifying can hinge on a few hundred dollars a month. When the monthly principal and interest payment drops by several hundred dollars versus the peak earlier in the year, buyers who were priced out regain purchasing power.

Inventory and Activity: Moving Toward Normal

National inventory has increased from pandemic-era lows and is moving back toward longer-term norms. The number of homes for sale climbed in 2025, and purchase applications remain higher than a year ago despite weekly fluctuations. Forecasts from a broad set of analysts show modest home price appreciation in 2026 on average, not a widespread collapse. The median expectation across multiple forecasters is modestly positive.

That matters locally. More homes for sale in Southwest Florida means a buyer market in many neighborhoods. When inventory increases, buyers gain negotiating leverage; when inventory contracts, sellers regain it. Right now the balance favors buyers in several SWFL submarkets.

Equity Building Remains the Central Long-Term Benefit

Homeownership still builds wealth in two ways: mortgage principal reduction and home price appreciation. Using a realistic five-year projection, a buyer who purchases a $400,000 home today can expect meaningful equity accumulation—estimates in industry surveys suggest averages in the tens of thousands of dollars over five years. That kind of forced savings is the primary reason ownership is central to long-term financial planning.

Southwest Florida Snapshot: Naples, Fort Myers, Marco Island

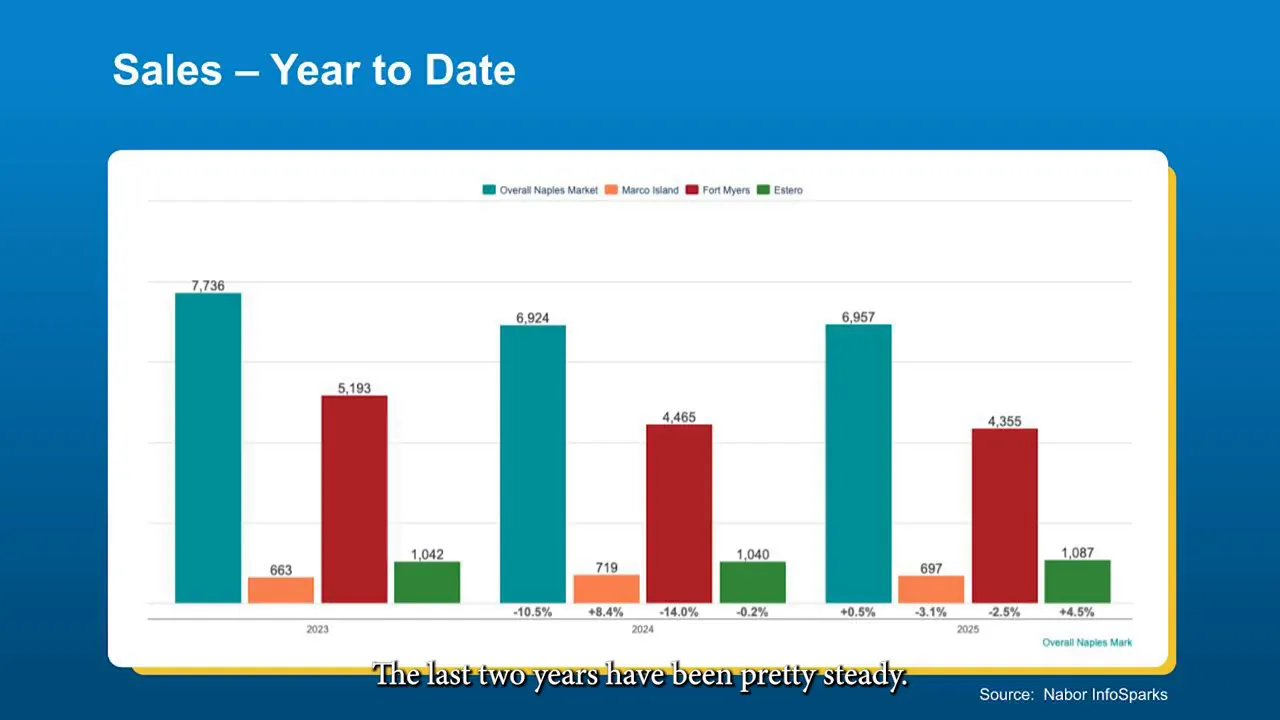

The SWFL market update for the region shows steady sales and rising inventory. Year-to-date sales in Naples have stayed relatively stable over recent years and Fort Myers shows similar steadiness. Marco Island, a smaller market, actually recorded increased activity in 2025 compared with earlier years.

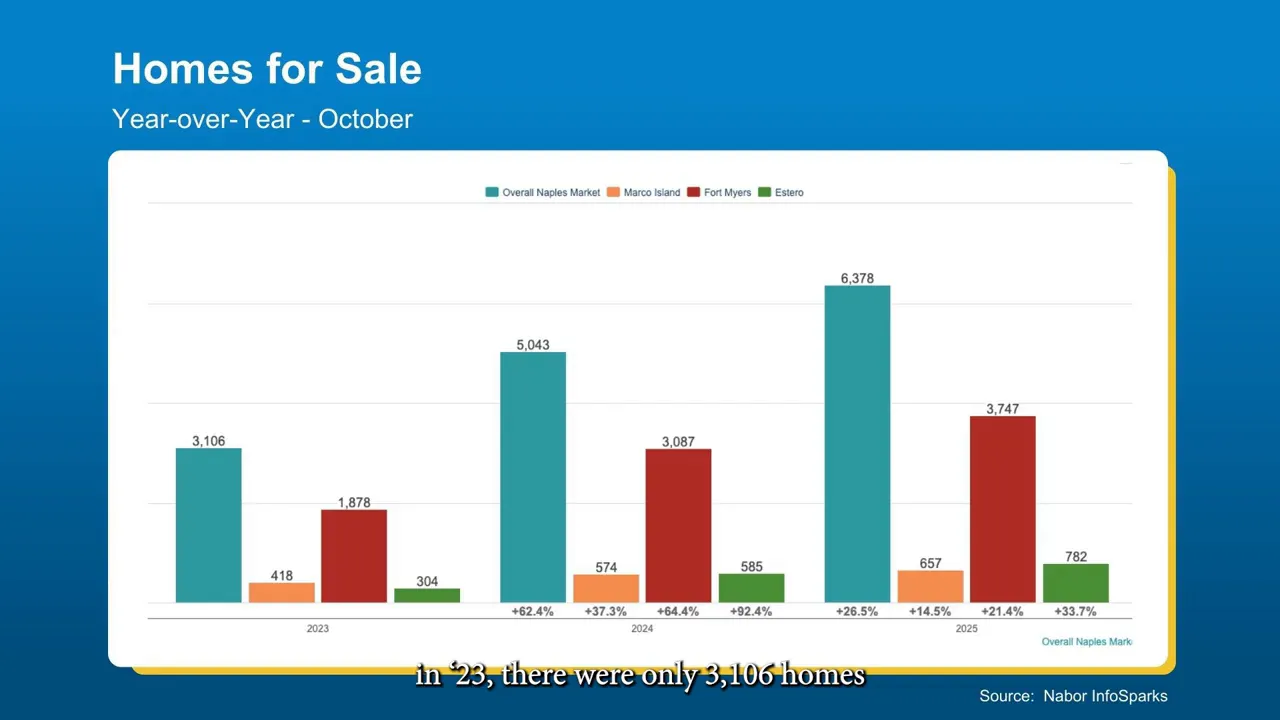

Inventory is up more noticeably than the national average. Naples listed inventory roughly doubled from 2023 to 2025 in October snapshots, moving the local market toward buyers. Days on market have crept up compared with the ultra-fast pace of the pandemic years, which means sellers who price aggressively still sell quickly, while those who overprice tend to sit longer.

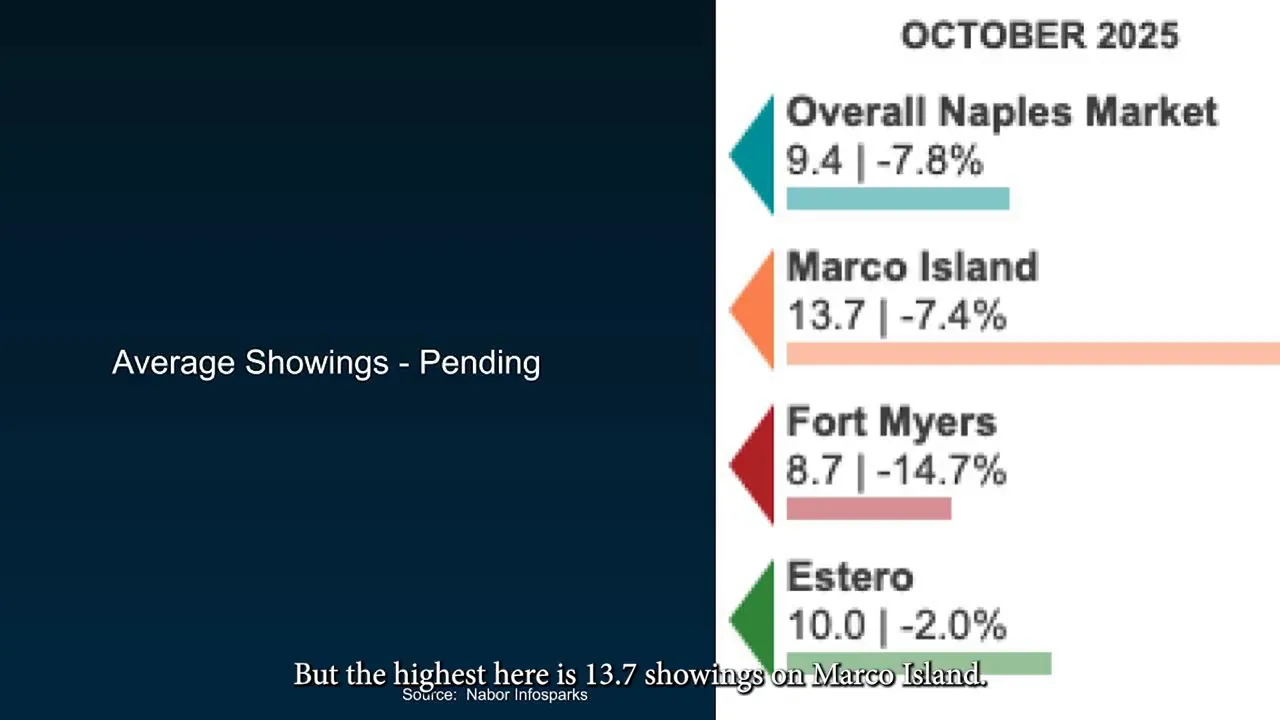

Another useful metric is average showings per pending sale. In some SWFL submarkets it takes 9 to 14 showings to reach a pending sale. If a well-marketed home has received more showings than the typical average and has not gone under contract, the likely issue is pricing or marketing strategy rather than demand.

How to Think About Timing: Is It Time To Move?

Timing depends on personal circumstances. Financially, the current mix of lower mortgage spreads, improved affordability, rising wages, and more inventory creates an environment where many buyers can find acceptable terms. For sellers, rising inventory means planning and pricing matter; a well-priced and well-marketed home will stand out.

Life events often determine timing more than short-term market gyrations. Relocations, family changes, downsizing needs, and the desire to stop renting are all valid reasons to act. Waiting for a hypothetical market bottom often creates opportunity costs. Every month: rent paid, commute time, family needs—those are real costs that factor into the decision.

Practical Takeaways for SWFL Buyers and Sellers

- Buyers: Increased inventory gives more choice. Shop with a clear qualification target and lock in affordability where possible.

- Sellers: Price for the market. Overpricing creates longer days on market and often results in lower net proceeds.

- Both: Consider long-term equity building. Homeownership remains a proven path to wealth accumulation through principal repayment and appreciation.

Is Now a Good Time To Buy in Southwest Florida?

Conditions are favorable for buyers in many SWFL neighborhoods: inventories have risen, affordability has improved, and mortgage spreads have narrowed. Whether it is the right move depends on personal finances and goals, but market conditions support active buying for qualified buyers.

Will mortgage rates fall soon?

Federal Reserve signals do not guarantee mortgage rate moves. Mortgage rates depend on Treasury yields, spreads, and market factors in addition to policy. Rates have eased from recent peaks, but borrowers should plan for some variability and focus on affordability strategies.

Are home values going to crash like in 2008?

Current fundamentals differ from the 2008 scenario. A large share of homeowners own their homes outright or carry significant equity, and mortgage underwriting is generally stronger today. Analysts project modest appreciation on average rather than widespread declines.

How much equity can a buyer expect in five years?

Projections vary by market and price tier, but industry surveys show meaningful five-year equity accumulation for a typical purchase. Equity builds through mortgage principal reduction and price appreciation; for example, a realistic forecast for a $400,000 purchase shows substantial equity gains over five years under average appreciation scenarios.

What should sellers prioritize in this market?

Sellers should prioritize correct pricing and strong marketing. Properties priced at market and presented well capture attention in a buyer-favored environment and generally sell faster and closer to list price.

Contact Us Today! |

|

Providing you the experience you deserve! |

| Click me |