In the August 2025 monthly update produced by the Bartos Group and presented by Mary Barts and mortgage expert Cheryl Stokes, the conversation focused squarely on the current real estate market Southwest Florida and how national trends are playing out locally. They walk through national data, mortgage-rate behavior, affordability strategies, and an in-depth look at inventory, sales, months-of-supply, and buyer activity across Naples, Marco Island, Fort Myers and Cape Coral.

A Tale of Two Markets

Nationwide the housing market continues to split along geographic lines. As Mary and Cheryl explained, regions traditionally labeled as “snow states” (Northeast and Midwest) remain relatively tight with stronger seller power, while many “sand states” (South and West) are seeing inventory growth and a shift toward buyer-favorable conditions.

This divergence matters for anyone thinking about moving between regions. Buyers and sellers who relocate often bring expectations shaped by their prior market: a buyer used to competitive Northeast conditions may be surprised by the flexibility available in parts of the South, while a seller coming from a low-inventory market may find more competition in Southwest Florida.

“Since the national pandemic housing boom fizzled out in 2022, the national power dynamic has slowly been shifting from sellers to buyers.” — Lance Lambert, Resi Club

Mortgage Rates: Calm, Stable, and Less Volatile

One of the most important takeaways from the update was the relative stability of mortgage rates. Multiple industry voices — including Sam Kedar from Freddie Mac, HousingWire analysts, and forecasting teams at Fannie Mae and major banks — describe the recent period as among the calmest for mortgage volatility in recent memory.

“Mortgage rates have moved within a narrow range for the past few months. Rate stability, improving inventory, and slower house price growth are an encouraging combination.” — Sam Kedar, Freddie Mac

That stability matters for planning. Rather than chasing daily headline rate swings, buyers and sellers can develop realistic expectations and strategies because rates have hovered in a tight band. Forecasters discussed a slowly downward trend for rates over the year, but emphasized that any decline is likely to be gradual — enough to help affordability over time, but not necessarily dramatic in any given month.

What stability means in practice

- Borrowers can plan around predictable payment scenarios rather than trying to time a distant rate drop.

- Small declines — even a quarter point — can meaningfully change monthly payments and qualification outcomes for first-time buyers.

- Lenders and agents can incorporate mortgage buy downs and seller concessions to create affordability where needed.

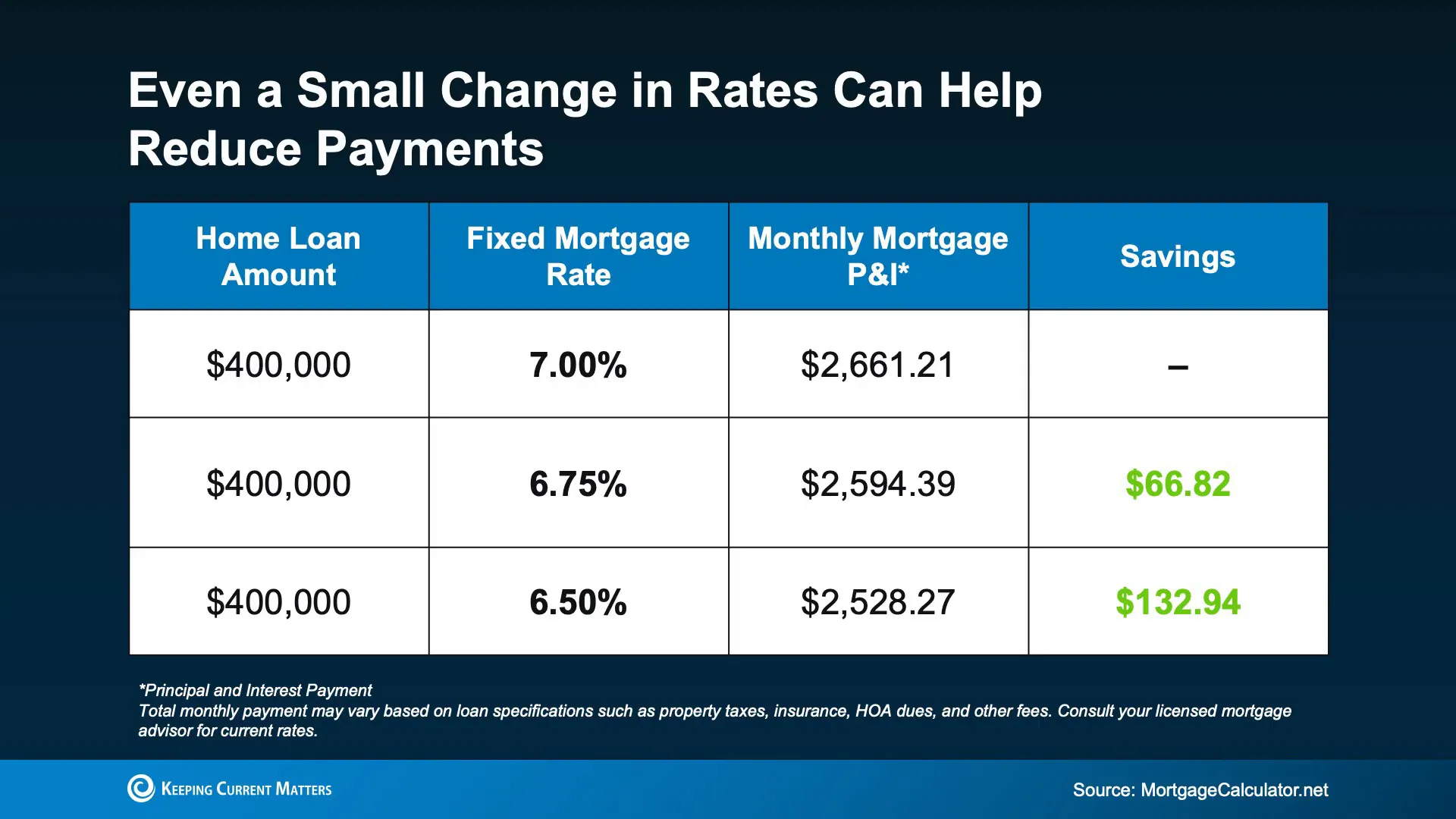

Affordability: Small Moves, Big Impact

Affordability remains the central challenge even with calm rates. During the update Cheryl highlighted how small interest-rate differences translate into substantial dollar savings on monthly payments. A quarter-point rate improvement on a typical $400,000 loan can be the difference between qualifying and not qualifying for many buyers.

Agents and lenders in a buyer-favorable local market can work together to structure offers that improve buyer affordability while preserving seller net proceeds. Typical tactics include:

- Seller credits toward closing costs that are redirected into rate buy downs.

- Negotiated price adjustments combined with buy downs to keep seller net acceptable yet lower buyer payment.

- Using temporary buy downs (e.g., 2-1 buy downs) to bridge buyers until they can refinance to a lower long-term rate.

“If the seller’s getting their net and the buyer is getting a rate and down payment they can afford, it’s a win-win.” — Cheryl Stokes

Local Snapshot: real estate market southwest florida by city

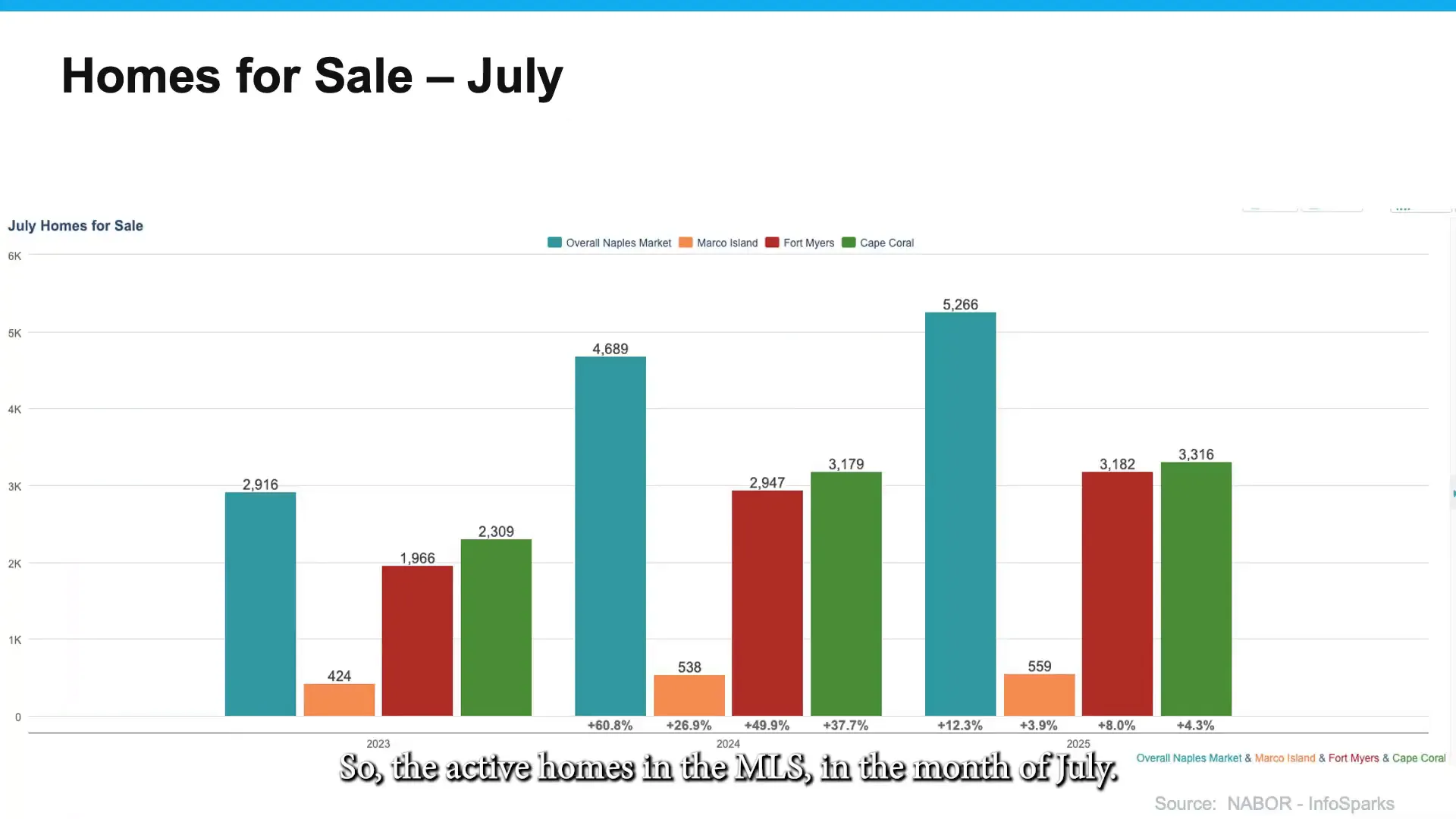

Turning local, the presenters dug into MLS statistics for Naples, Marco Island, Fort Myers, and Cape Coral. Inventory increases are the headline: active listings across these markets are higher than the same period in 2023 and 2024, with Naples showing a particularly sizable supply.

Highlights from the local data:

- Naples had the largest active inventory in July with over 5,200 homes for sale and added 815 new listings that month alone.

- July sales in Naples were roughly comparable to prior years — around 600+ transactions — but year-to-date totals showed a slight decline from 2023.

- Inventory growth, rather than a collapse in demand, is the primary driver of the shifting market dynamic locally.

In short: more homes are coming to market while sales remain relatively stable. That creates more choice for buyers, more negotiation room, and longer times on the market for homes priced above market expectations.

Months of Supply and Showing-to-Pending Ratios

Months-of-supply is the single best quick indicator of local market balance. A six-month supply typically indicates a neutral market; less than that favors sellers and more favors buyers. In this update:

- Naples and Marco Island were on the higher side of months-of-supply, indicating a buyer-leaning market there.

- Fort Myers and Cape Coral were closer to neutral but still trending toward more supply as listings increase.

Mary and Cheryl also discussed showings-to-pending ratios: how many showings it takes on average to reach a pending sale. Those figures are a practical tool for sellers to set expectations:

- The Cape: about 13.4 showings per pending.

- Fort Myers: roughly 10.3 showings per pending.

- When a market delivers only a few showings per month, sellers should expect longer marketing times unless pricing and presentation are dialed in.

Timing: Is Now the Right Time to Move?

Timing decisions always depend on personal circumstances, but the presenters offered clear tactical advice for both buyers and sellers in the current real estate market southwest florida.

For buyers: August through early October is an advantageous window. Inventory is relatively high, rates are stable and trending slightly downward, and sellers who have been on the market for some time are often more open to concessions that improve affordability.

For sellers: Listing before the larger October and January influx of new inventory can be strategic. Though inventory has risen, there are still windows where competition is lower and motivated buyers remain active.

“If it’s your time to move—relocating, first-time buyer, downsizing—it’s a good time to act.” — Mary Bartos

Practical Advice for Buyers and Sellers

- Buyers: talk to a lender early. Discuss buy down options, seller credits, and realistic qualification scenarios rather than chasing hypothetical future rate drops.

- Sellers: price for today’s market. Homes priced appropriately still sell; those priced above will sit and generate fewer showings.

- Agents: craft offers that solve both buyer affordability and seller net expectations — concession structures can unlock deals.

Conclusion

The August 2025 update makes one thing clear: the real estate market southwest florida is in a transition phase characterized by rising inventory, calm mortgage rates, and meaningful opportunities for buyers and sellers who plan strategically. While national patterns reflect a split between regions, local data shows steady sales with growing choice for buyers and increasing necessity for accurate pricing among sellers.

Local expertise and lender coordination are the most valuable resources in this environment. Whether the goal is to buy, sell, downsize, or relocate, professionals who understand mortgage products and local market mechanics can create solutions that turn a complex market into a manageable one.

FAQ — Common Questions about the Real Estate Market Southwest Florida

Q: Is this a good time to buy in the real estate market Southwest Florida?

A: Yes. With increased inventory, stable mortgage rates, and seller flexibility in many cases, buyers have more options and negotiating power now than in prior years. Buyers should work with a lender to explore buy downs and seller concessions that improve affordability.

Q: Are mortgage rates expected to drop soon in the real estate market Southwest Florida?

A: Forecasts suggest a slow, gradual decline rather than a sharp drop. Experts emphasize rate stability and caution against timing the market; small rate improvements can help, but they may be incremental.

Q: How does months-of-supply affect sellers in the real estate market Southwest Florida?

A: Higher months-of-supply typically mean more competition and longer marketing times. Sellers should ensure accurate pricing and strong marketing to attract buyers quickly and avoid extended time on market.

Q: Can sellers provide concessions to help buyers in the real estate market Southwest Florida?

A: Absolutely. In a buyer-leaning market, seller credits can be used to buy down rates or cover closing costs, enabling transactions that work for both parties while preserving the seller’s desired net proceeds.

Q: What should a buyer prioritize when searching in the real estate market Southwest Florida?

A: Prioritize mortgage pre-approval, flexibility on closing structure, and a local agent who knows which neighborhoods have rising inventory versus more limited supply. An agent-lender team that can craft creative offers will give buyers an edge.

Q: Where can sellers get the best advice on pricing and marketing in the real estate market Southwest Florida?

A: Sellers should consult a local agent with recent sales data and a proven marketing plan. Agents who track showing-to-pending ratios and months-of-supply can provide realistic timelines and pricing strategies tailored to the seller’s goals.

Contact Us Today! |

|

Providing you the experience you deserve! |

| Click me |