The Bartos Group presents practical, no-nonsense guidance for anyone considering moving your homestead in Florida. In a recent episode of Really Mary, host Mary Bartos and real estate attorney Peter Huy unpack the legal and tax benefits tied to Florida homestead status, explain the powerful Save Our Homes protection, and walk through the portability rules that let homeowners carry tax savings from one property to the next. This article distills that conversation into a clear, step-by-step resource for homeowners, buyers relocating to Florida, and anyone researching moving your homestead.

Outline: What This Blog Covers

- What homestead status means in Florida

- Key benefits: creditor protection and tax caps

- Save Our Homes: how annual caps build savings over time

- Portability: moving your homestead tax benefit to a new property

- Practical steps to apply and transfer the benefit

- Common scenarios and an illustrative example

- FAQ section addressing deadlines, documentation, and limitations

What Does Homestead Status Mean in Florida?

Homestead status in Florida refers to a set of legal protections and tax advantages specifically available to homeowners who designate a qualifying property as their permanent residence. These laws are intentionally broad: they provide protection from certain creditors, may offer defenses in matrimonial disputes, and—perhaps most compelling for many homeowners—place limits on how fast the assessed value used for property taxation can rise.

When discussing moving your homestead, it’s important to separate two related ideas: the protective legal shield that comes with homestead designation, and the financial shield created by the tax assessment caps known as Save Our Homes. Both matter, but the tax component is often the driver that prompts homeowners to learn the portability rules.

Key Benefits: Creditor Protection and Tax-Capped Growth

Florida homestead protections have two main effects that homeowners notice most:

- Legal protections: Homestead can protect a primary residence from forced sale by certain creditors and may influence property division in divorce or other family law matters.

- Tax protections: The Save Our Homes benefit places a cap on how much the assessed value of a homesteaded property can increase each year—typically limited to 3% or the rate of change in the Consumer Price Index, whichever is lower—significantly slowing how much property tax increases over time.

The combination of legal and tax protections makes homestead designation one of Florida’s most valuable homeowner benefits. For people moving your homestead or planning to, this is where the real financial opportunity lies.

Save Our Homes Explained: The Annual Cap That Compounds

The Save Our Homes (SOH) provision creates an annual cap on assessed value increases for homesteaded property. That cap means that, even when market values surge, a homesteaded property’s taxable assessed value can only increase at a limited rate. Over years and decades, this capped growth can accumulate into a substantial “aggregate discount” between market value and assessed value—translating into real tax savings.

For many long-term owners, the result is striking: despite strong market appreciation, property tax bills remain much closer to what they were years earlier. This accumulating benefit is the reason why moving your homestead requires careful attention—because you can often carry a portion of that aggregate discount with you to a new primary residence.

Portability: Take Your Save Our Homes Benefit With You

One of the most important pieces of moving your homestead is portability. Under Florida law, homeowners who sell their homesteaded residence and buy a new primary residence can transfer (or “port”) some or all of their accumulated SOH benefit to the new property. This portability can dramatically reduce the assessed value of the new home for tax purposes.

Key portability points homeowners should know:

- The ported amount comes off the new home’s assessed value, decreasing the property tax base.

- There is a cap on the amount that can be ported—currently up to $500,000 of the aggregate benefit may be transferred.

- The process is county-administered through the local property appraiser’s office, and procedures can vary regionally.

Example

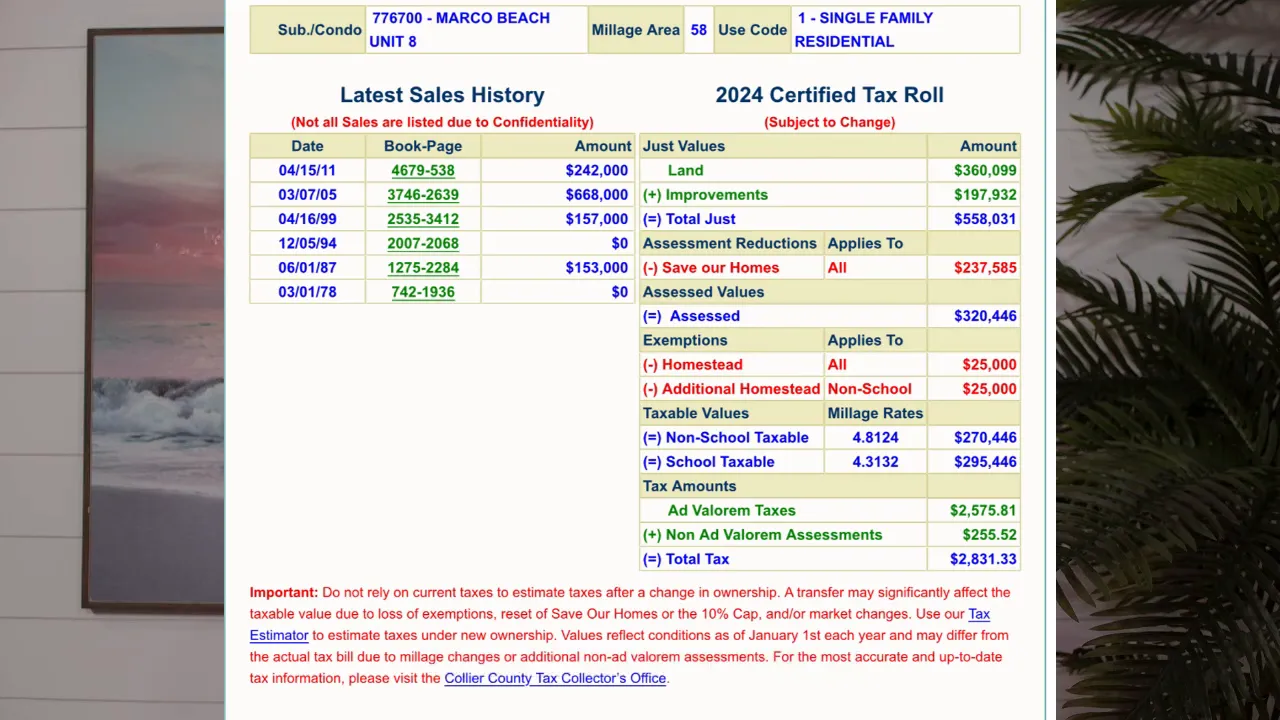

To make portability more concrete, consider an anonymized example discussed by the panel. A homeowner purchased a home in 2011 for $242,000. Over the next decade-plus, the market accelerated: the appraised market value grew to $558,000. Because of Save Our Homes, the homeowner’s aggregate discount—the difference between market value and the homestead-protected assessed value—reached approximately $237,000.

When that homeowner decides to move and purchases a new, higher-priced home, that $237,000 (subject to the portability cap) can come off the new home’s assessed value. If the new property’s market assessment places it in a higher tax bracket, the ported amount directly reduces the taxable base, which can translate to thousands of dollars in annual savings.

How To Transfer the Benefit: Practical Steps and Timing

Moving your homestead is surprisingly straightforward in concept, but it requires attention to county procedures and deadlines. Below are practical steps every homeowner should follow:

- Confirm your current SOH benefit. Visit your county property appraiser’s website and look up your property or name to see the current assessed value and the aggregate SOH discount. Most counties provide a chart or breakdown showing how the assessed value was calculated.

- Purchase your new primary residence. Portability applies only when a new property becomes the homeowner’s permanent residence.

- Apply for portability promptly. While counties accept pre-applications in many cases, there are standard filing windows. Generally, initial homestead applications are filed between January and the tax deadline—many jurisdictions reference March 1 as a key date. Homeowners should apply as soon as possible after closing to ensure the ported benefit is applied for the tax year.

- Attend the required in-person appointment if your county requires it. Some counties require the homeowner to complete portability forms in person at one of a few appraiser office locations to verify identity and documentation. Arrive with a government-issued ID, closing documents, and proof of residency as requested by the county office.

- Let the appraiser’s office calculate and apply the benefit. County appraiser staff will typically process the paperwork and apply the ported amount to the new property’s assessment.

Note: Even if a county provides online forms, some offices prefer to process portability and homestead applications in person to avoid errors. Homeowners should check their county’s property appraiser website for the exact process and available locations.

Documents commonly requested

- Valid photo ID (driver’s license or passport)

- Closing statement or deed showing purchase date and ownership

- Proof of permanent residence (driver’s license change, voter registration, utility bills)

- Previous homestead documentation (if available)

Common Questions About Moving Your Homestead

Below are answers to frequently asked questions that surface when homeowners consider portability.

Q: Can a homeowner move the entire SOH discount to the new home?

A: Portability lets a homeowner transfer accumulated SOH benefits up to a statutory limit. The cap on ported benefit is currently $500,000. Homeowners with aggregate discounts above that limit will not be able to transfer the excess beyond the cap.

Q: Does portability reduce the assessed value or the market value?

A: Porting reduces the new home’s assessed value for taxation purposes. Market value remains a separate estimate of the home’s worth; portability affects how much of that value is subject to tax.

Q: When is the deadline to apply for homestead or portability?

A: Deadlines can vary by county. Homeowners should generally apply as soon as they purchase and move into their new primary residence. Many counties accept homestead applications from January through March 1 for the tax year. Pre-applications may be possible in some jurisdictions—check the local property appraiser website.

Q: Can an agent or attorney file portability on behalf of the homeowner?

A: Many counties require the homeowner’s presence for identity verification and signing. While forms might be available online, county offices may insist on an in-person visit to complete the application. This means a homeowner typically must file in person, though some clerical steps and preparatory work can be assisted by a representative.

Q: What if the new home is much more expensive—how does portability affect taxes?

A: Ported SOH benefits apply to the assessed value and will reduce the taxable base of the new home. The effective tax savings will depend on the new home’s market assessment, local millage rates, and the amount of ported benefit applied. Even on high-priced homes, porting several hundred thousand dollars of assessed-value reduction can yield meaningful annual tax savings.

Final Thoughts: Why Moving Your Homestead Matters

Moving your homestead is more than an administrative task—it is a tax strategy with long-term implications. For homeowners who have built up a significant Save Our Homes benefit, portability can preserve years of tax savings when upgrading or relocating. The process is county-specific and may require an in-person visit, but the time spent is generally brief and well worth the potential reduction in future property taxes.

Homeowners planning a move should start early: verify the current SOH discount through the county property appraiser’s website, gather required documents before closing, and apply for portability as soon as the new home becomes the primary residence. With the right timing and paperwork, moving your homestead can preserve hard-earned savings and make a substantial difference in long-term tax liability.

Contact Us Today! |

|

Providing you the experience you deserve! |

| Click me |