The October Market Update SWFL breaks down the national headlines and pairs them with what is actually happening in Southwest Florida. Inventory has risen, price growth is moderating, and local conditions are more stable than many national stories suggest. This report explains the key metrics affecting affordability, mortgage rates, and local sales activity across Naples, Marco Island, Fort Myers, and Bonita Springs, and it offers practical guidance for anyone thinking about a move.

Inventory and Price Adjustments: More Homes, More Price Moves

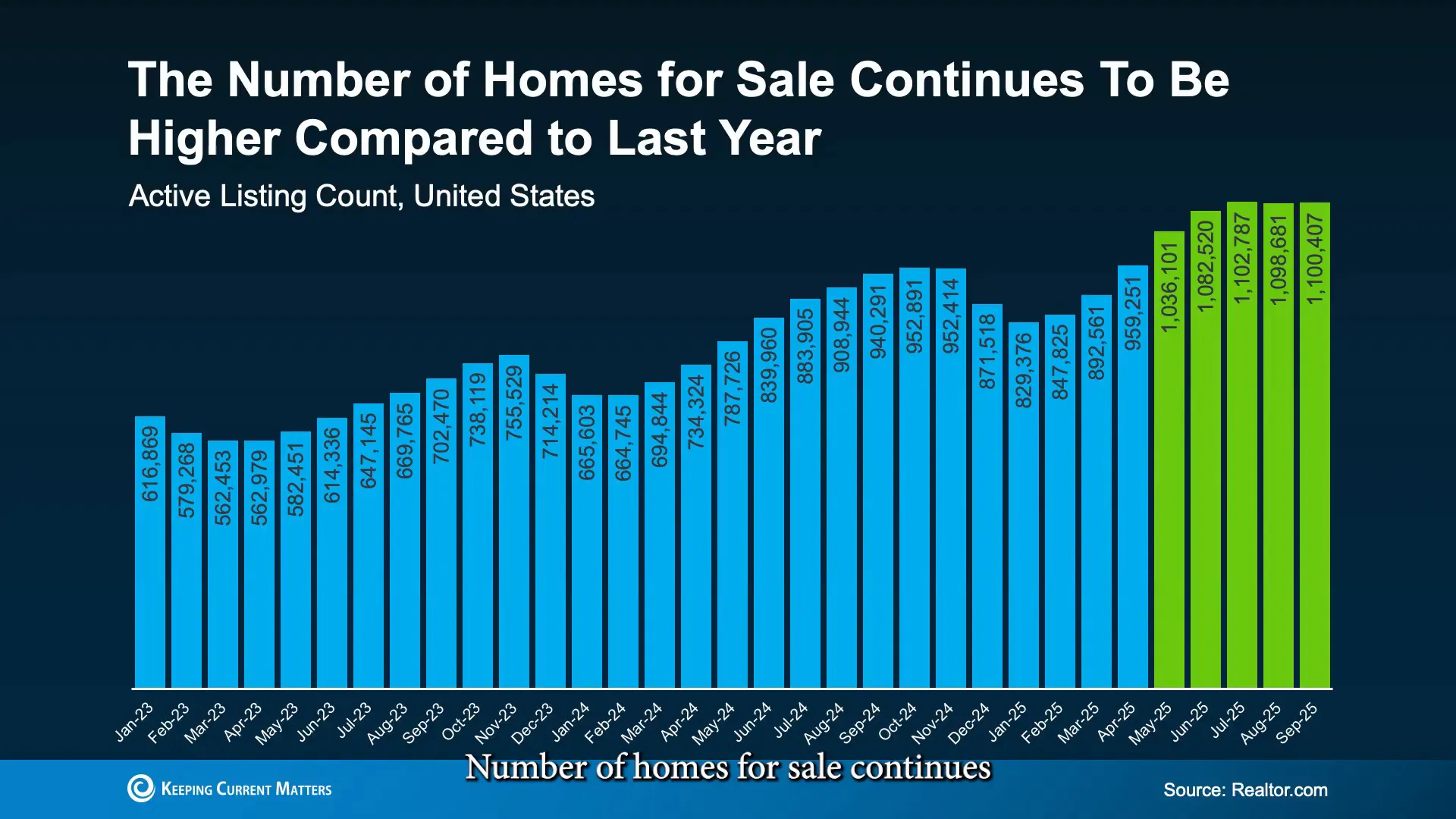

Nationally, the number of homes for sale has increased versus last year. This is reflected in month-to-month data showing a higher supply of listings. Concurrently, price modification activity is normalizing: in August, roughly 20.3 percent of U.S. listings showed price changes, and Florida sat slightly higher at around 22 percent. Those figures indicate sellers are responding to rising inventory by adjusting prices to stay competitive.

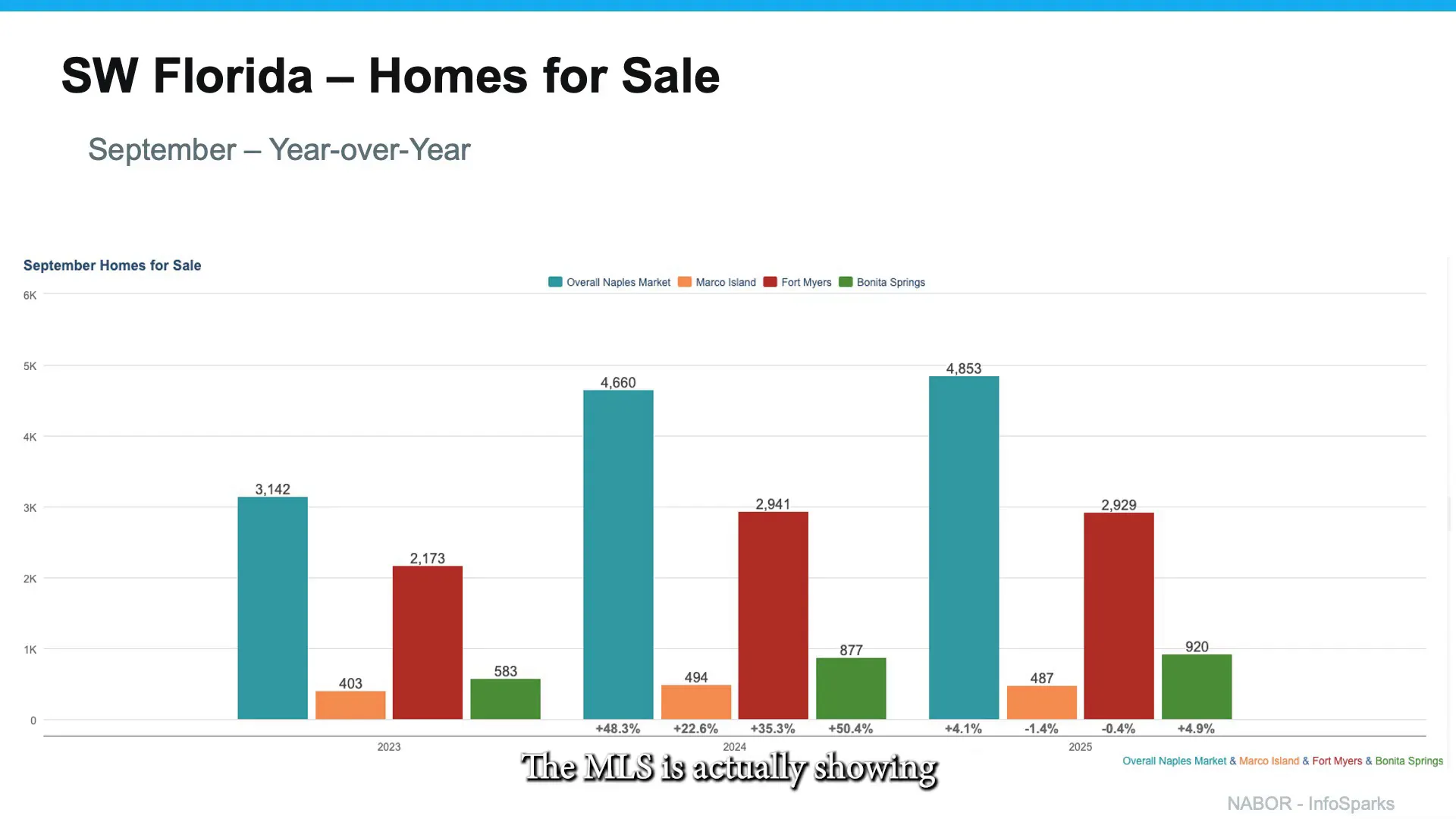

In Southwest Florida the pattern is similar but more nuanced. The MLS and local data show that homes for sale have been relatively stable compared with the prior year. Naples has experienced a modest uptick in inventory, while other areas like Marco Island, Fort Myers, and Bonita Springs have shown stability month over month. Stability in inventory often leads to steadier negotiation dynamics for both buyers and sellers.

Home Price Growth: Moderating, Not Collapsing

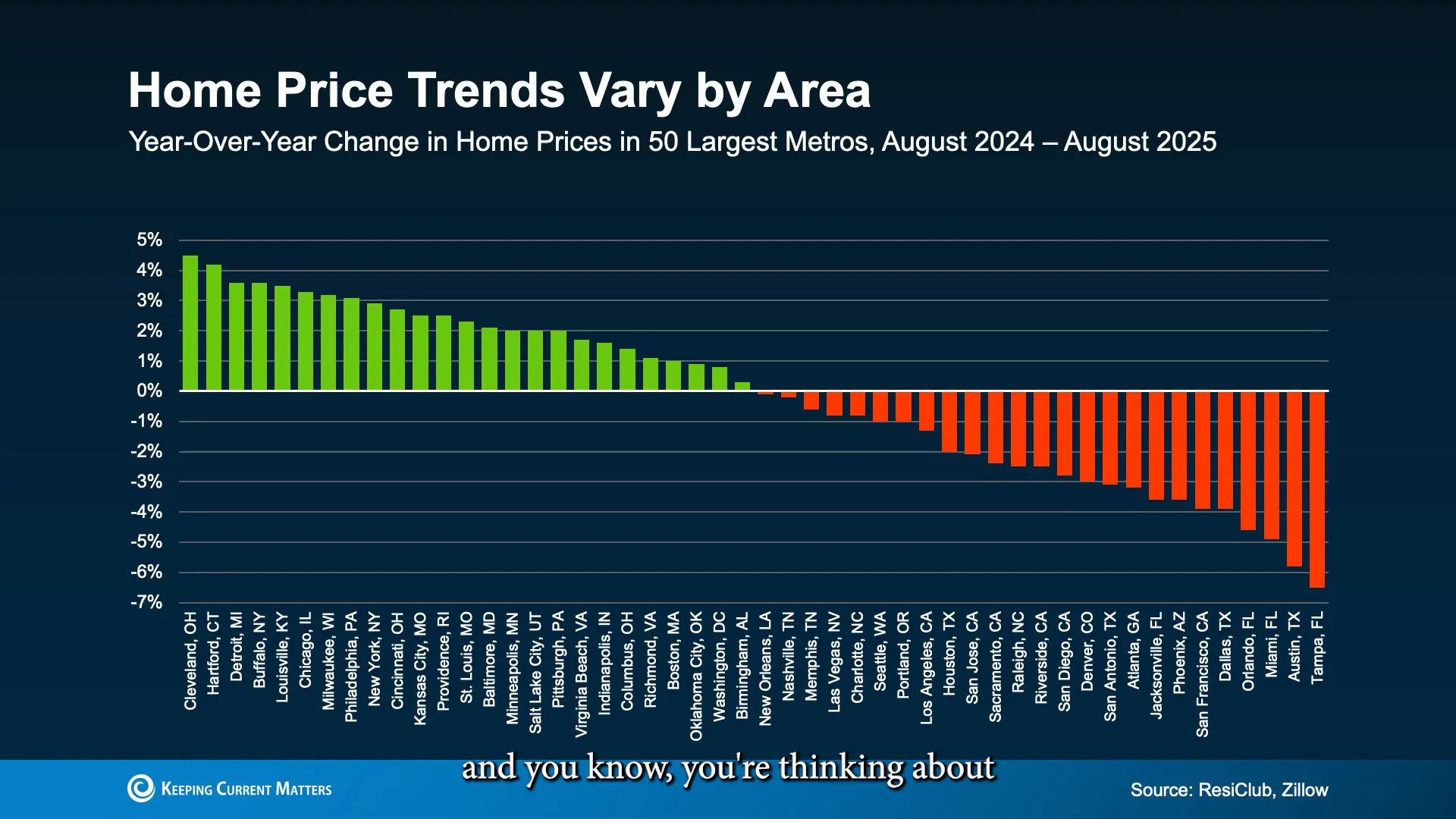

Price growth has slowed from the dramatic increases seen in early 2024. To put this in perspective, year-over-year national home price growth moved from roughly 6.5 percent in January 2024 down to about 2.3 percent by July 2025 according to federal housing indicators. That trend is a moderation, not a decline. Headlines that suggest a market collapse miss this important distinction: prices are leveling rather than falling off a cliff.

Market outcomes are fragmented by region. Higher-latitude “snow states” still display positive year-over-year price trends in many cities, while some “sand states” or Sun Belt locales are seeing negative or flatter year-over-year moves. Southwest Florida is not uniformly negative; local medians show mixed movements and overall leveling rather than large declines.

Why Regional Differences Matter

Buyers relocating from other regions need to understand that markets are not interchangeable. For example, someone selling a home in a high-demand snow state may experience a very different result than a seller in Southwest Florida. Local inventory, buyer demand, and seasonality all shape outcomes, so comparisons should be made carefully.

The Fed, Inflation, and Mortgage Rate Expectations

Inflation remains above the Federal Reserve‘s 2 percent target but has come much closer than earlier in the cycle. The Fed recently enacted a rate cut despite inflation staying elevated; that reflects a broader balancing act. Policymakers weigh inflation, labor markets, and other indicators when deciding the path of policy. Unemployment and job growth have a real influence on these decisions.

Many buyers mistakenly assume that a Fed cut automatically produces lower mortgage rates. Mortgage rates are influenced by multiple forces, and the Federal Funds rate is only one of them. The 10-year Treasury yield tends to be a stronger short-term predictor of mortgage rates. Historically, the spread between the average mortgage rate and the 10-year Treasury has been about 1.76 percent. That spread widened to as much as 2.76 percent during recent volatility but had narrowed to around 2.1 percent by September. That narrowing spread suggests mortgage rates are trending in the favorable direction, though not necessarily at the speed everyone hopes for.

Mortgage Rate Projections and Practical Advice

Industry forecasts from organizations such as Fannie Mae, the Mortgage Bankers Association, and major banks like Wells Fargo suggest mortgage rates could average between 5.9 percent and 6.4 percent by the fourth quarter of 2026. Those projections are useful context but come with a large margin of uncertainty. Historically, market dynamics and unexpected economic data cause forecasts to shift.

Practical guidance for buyers and sellers is to focus on today’s rates and what is affordable right now rather than waiting for a prediction. Waiting for a hypothetical drop risks missing the right property or favorable terms. When mortgage rates dipped into the mid to low 6 percent range recently, national mortgage inquiries and applications rose noticeably. That demonstrates how sensitive buyer behavior is to perceived rate changes.

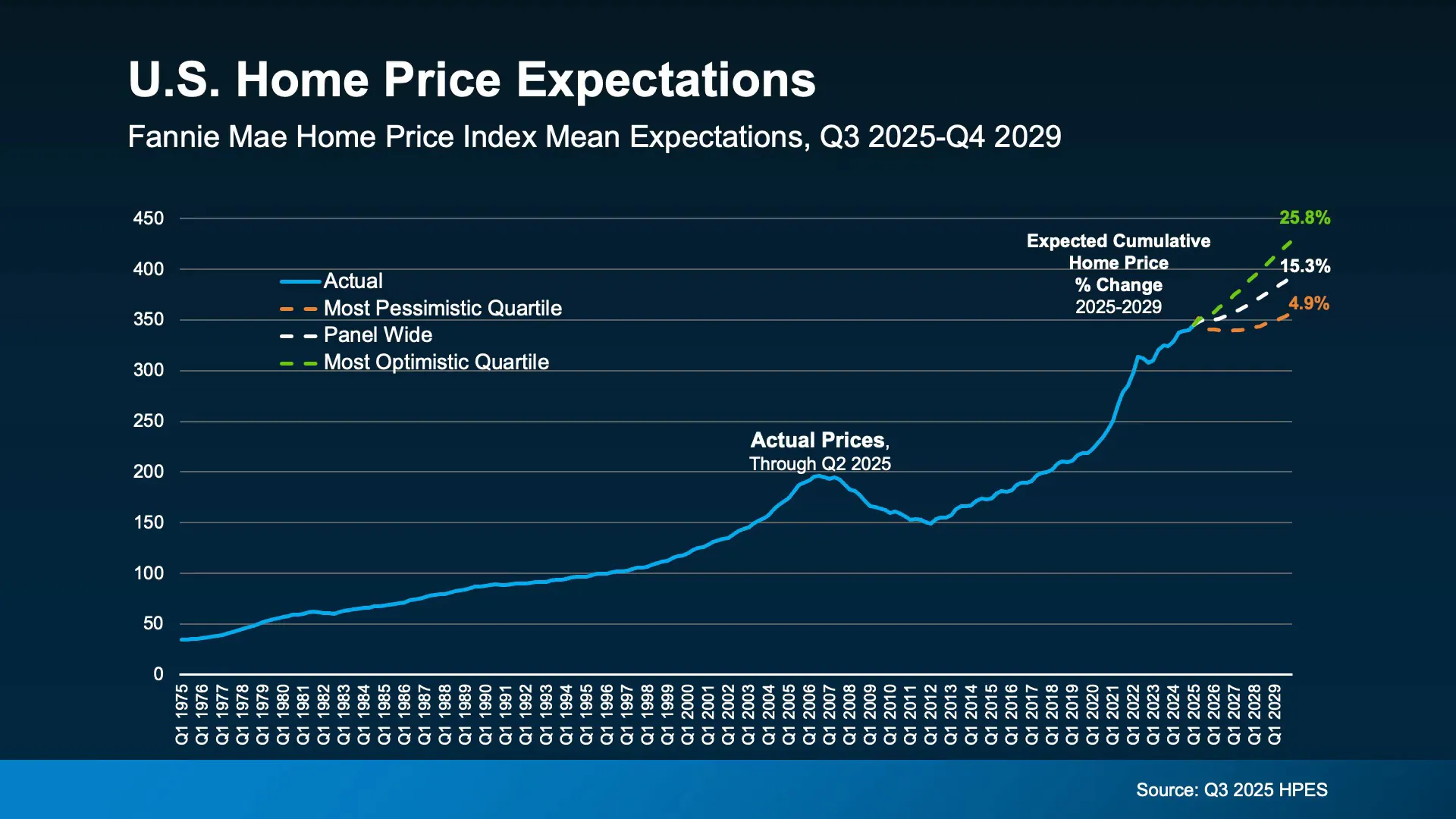

Supply, Demand, and Price Outlook to 2029

Fannie Mae released a price index and panel projections covering Q3 2025 through Q4 2029. The most optimistic quartile of their panel anticipated total price growth of about 25.8 percent over that period, averaging a little over 6 percent per year. The most pessimistic quartile still projected positive cumulative growth of around 4.9 percent over the same four-year window. In short, the consensus range favors ongoing modest appreciation rather than widespread declines.

These projections assume that if mortgage rates trend lower and buyer demand increases while inventory remains controlled, prices will respond upward. Importantly, the housing market today carries much more homeowner equity than during previous downturns. Approximately 60 percent of U.S. homeowners currently hold greater than 30 percent equity in their homes, a dramatic change from the last major crash where many owners were underwater. That equity buffer reduces the risk of forced sales and makes a crash like 2008 unlikely under current conditions.

Southwest Florida: What the Local Numbers Show

Breaking the regional numbers down, Southwest Florida displays a balanced and stable set of indicators:

- Homes for sale: Relatively stable year over year with modest increases in some pockets like Naples.

- Pending sales: Fairly steady across the county, indicating listings priced and staged correctly still convert.

- Conversion rate: Roughly 47 percent of homes listed so far this year went under contract. That means nearly one out of every two listings that enters the market sells if it is priced and presented properly.

- Total closed sales: Stable month to month with some variance by neighborhood.

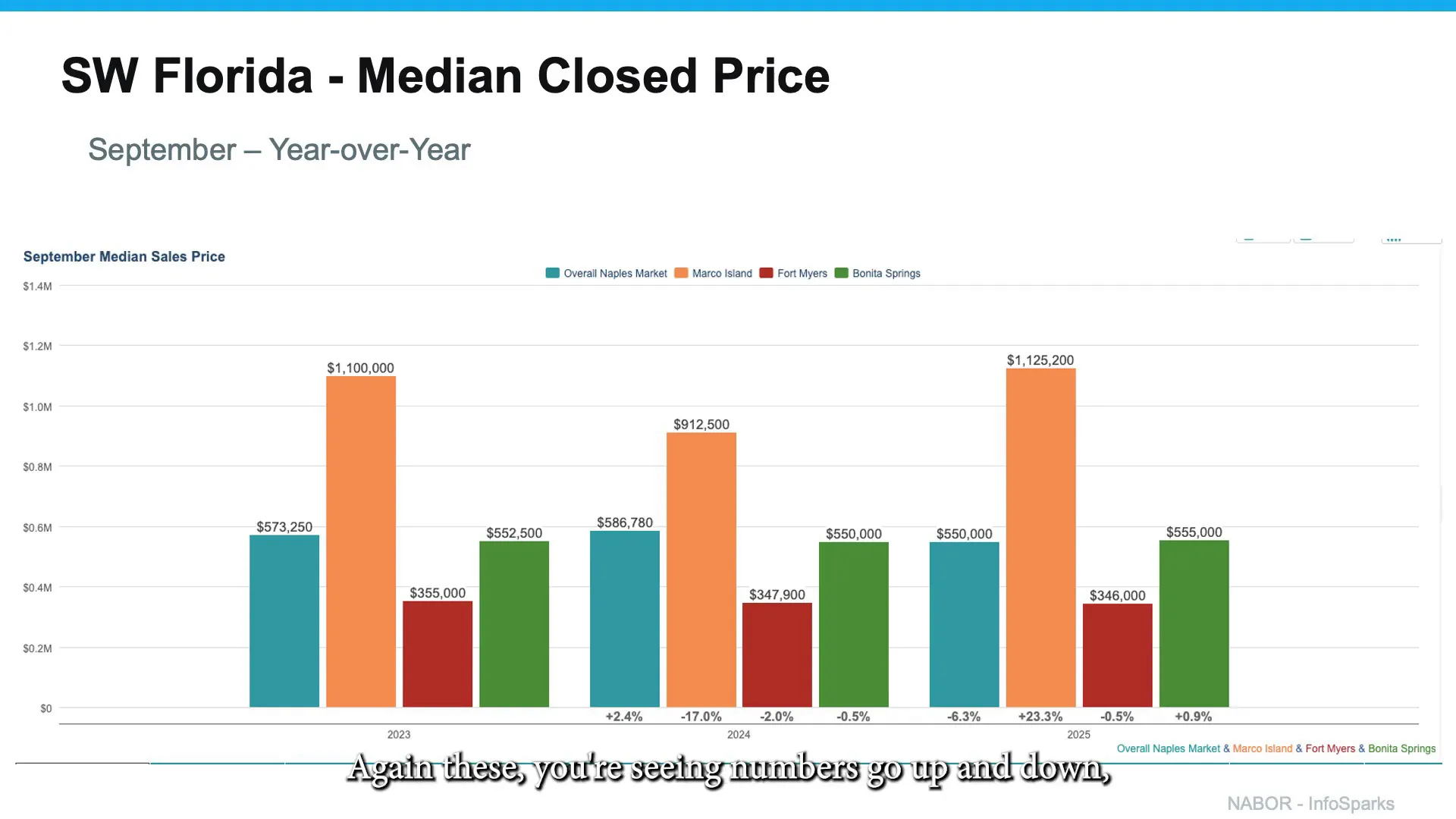

- Median closed prices: Local medians show differences among Marco Island, Naples, Fort Myers, and Bonita Springs but overall indicate leveling rather than sharp declines.

One key local takeaway is that pricing and condition remain the top determiners of success. When a property is priced right and presented well, the odds of a pending sale remain high. Conversely, homes that are mispriced can remain in what some call inventory jail for extended periods.

Is Now the Right Time to Move?

The short answer is: it depends. Decisions should be tailored to individual goals. Reasons that make a move advisable include:

- Need for more or less space (upsizing or downsizing)

- Relocation for work or lifestyle (moving north or moving into Southwest Florida)

- Investment objectives, such as acquiring a second home or rental property

- Retirement and lifestyle changes

When a move makes sense personally and financially, the current market provides workable options for both buyers and sellers. If the move does not make sense—either because it does not align with personal goals or because the finances do not line up—then holding off may be the right decision. In either case, expert guidance helps weigh the tradeoffs and build an action plan that leverages current conditions.

Actionable Tips for Buyers and Sellers

- For sellers: Price competitively and invest in condition. Nearly half of listings that go on the market this year have moved to pending status, signaling that buyers still reward well-priced, well-maintained homes.

- For buyers: Run affordability scenarios based on current mortgage rates and explore rate-reduction strategies. Expect more content on practical tactics to lower your effective mortgage rate and improve qualification.

- For everyone: Focus on local data rather than national headlines. Regional fragmentation means micro-markets behave differently.

- Monitor the 10-year Treasury yield as an additional indicator for mortgage rate direction. The mortgage-Treasury spread historically averages about 1.76 percent and has been compressing from recent highs.

Bottom Line

The October Market Update SWFL shows a market that is balancing rather than crashing. Price growth has moderated, inventory has edged higher, and local metrics in Southwest Florida present a steady picture. Forecasts into 2026 and beyond vary, but most serious projections show continued appreciation, albeit at a more modest pace than the surges seen in the prior two years. Homeowners now carry more equity, and buyers respond quickly to perceived rate improvements.

Decisions to buy or sell should be driven by personal objectives and affordability today, not by headlines or forecasts alone. When property is priced and presented properly, it will sell. When buyers align with realistic affordability and professional guidance, they can capture value in this balanced market.

FAQ

What does the increase in homes for sale mean for Southwest Florida buyers and sellers?

An increase in inventory gives buyers more choices and creates leeway for negotiation, but the local market remains stable. Sellers who price and stage their homes correctly still move quickly, and roughly 47 percent of listings this year have gone under contract. In short, buyers benefit from options while price and condition continue to matter most for sellers.

Will mortgage rates drop immediately after the Fed cuts rates?

Not necessarily. Mortgage rates are not directly tied to the federal funds rate alone. They are influenced by multiple factors, including the 10-year Treasury yield, market expectations, and the mortgage-Treasury spread. Historically, the spread averages about 1.76 percent; recent months have seen the spread compress, which is a positive sign, but lower Fed rates do not guarantee immediate lower mortgage rates.

Are home prices going to crash in Southwest Florida?

A crash similar to 2008 is unlikely because most homeowners now have significant equity. About 60 percent of U.S. homeowners have more than 30 percent equity, reducing the likelihood of widespread distressed sales. Current projections show modest appreciation over the next few years rather than steep declines.

How should someone decide whether to move now or wait?

Decisions should be based on personal goals, financial readiness, and current affordability. Consider reasons like size needs, relocation, lifestyle changes, or investment goals. Consult with real estate and mortgage professionals to model scenarios using today’s rates, and weigh the risk of missing the right property against potential future rate changes.

What local metrics should buyers and sellers watch in Southwest Florida?

Track listings inventory, pending rates, median closed prices, and local days on market. Also monitor the conversion rate of new listings to pending status; locally nearly half of listings this year went pending, indicating the importance of correct pricing and presentation.

Contact Us Today! |

|

Providing you the experience you deserve! |

| Click me |