The Bartos Group presents this September Southwest Florida Market Update to break down the latest moves from the Federal Reserve, the national housing trends, and what those changes mean for buyers and sellers across Naples, Marco Island, Fort Myers, and Bonita Springs. This September Southwest Florida Market Update distills the headlines—Fed rate action, inflation trends, and regional market data—into clear takeaways and practical advice local homeowners can use today.

In this September Southwest Florida Market Update, Mary Bartos of Premiere Plus Realty and Randy Williams of TBF Mortgage walk through the most important numbers, explain how mortgage rates react to Fed policy, and show why opportunity is appearing in pockets across the region. Below is a structured summary with charts, local metrics, and answers to the questions homeowners ask most right now.

Quick Snapshot: Economy, Inflation, and the Fed

Nationally, the economic conversation has shifted toward recession risk. As noted in this September Southwest Florida Market Update, respected economists have increased the probability of an economic slowdown. Importantly, the speakers stressed that a recession historically does not automatically mean higher mortgage rates—often it works the other way.

Key facts from the update:

- Fed action: The Federal Reserve cut the federal funds rate by 25 basis points during the September meeting.

- Inflation: Inflation has fallen substantially from pandemic-era peaks; it remains under 3% nationally, down from about 5.3% in March 2022.

- Employment: Unemployment is holding steady while job growth is stalling—this combination influenced the Fed’s decision to reduce rates.

Why the Fed Cut Doesn’t Mean an Immediate Mortgage Rate Drop

One of the core lessons of this September Southwest Florida Market Update is the difference between the federal funds rate and mortgage rates. The 25 basis point cut directly affects short-term consumer credit—credit cards, HELOCs, and car loans. Mortgage rates, however, track the 10-year Treasury and broader market expectations.

Randy Williams emphasized that borrowers should not expect a quarter-point reduction to translate into a quarter-point drop in mortgage interest rates. Instead, mortgage pricing depends on bond markets, inflation expectations, and the pricing already embedded in rates. In fact, mortgage markets had largely priced in the anticipated Fed move before the announcement.

Mortgage Rates and Timing: What the Data Shows

This September Southwest Florida Market Update notes that mortgage rates in recent weeks reached the lowest levels Randy has seen in three years. Mortgage rates are sensitive to employment reports: historically weak jobs numbers have produced rate declines this year. For example, a weak jobs report in August corresponded with a drop in mortgage pricing.

Market expectations matter: CME Group polling indicated most traders expected multiple cuts this cycle, and mortgage pricing moved in advance to reflect those expectations. Practically, that means timing matters for buyers who want to lock a rate and for sellers who are watching buyer demand return as financing becomes more affordable.

The National Housing Market: Flattening, Not Collapsing

The national picture is stabilization more than crash. As presented in the September Southwest Florida Market Update, listing prices nationwide have largely flattened. Realer.com data showed listing medians roughly flat year-over-year: July 2023 median list price roughly $440k, July 2024 about $347,250 (noting sampling differences), and the most recent July at about $439,450—overall a flattening trend rather than a steep drop.

Analysts such as Odetta Kushi from First American argue for regional variation: the fundamentals support moderation in pricing rather than a sharp decline. That means some markets will cool modestly while others maintain robust gains.

Regional Dynamics: Snow States vs. Sand States and What It Means Locally

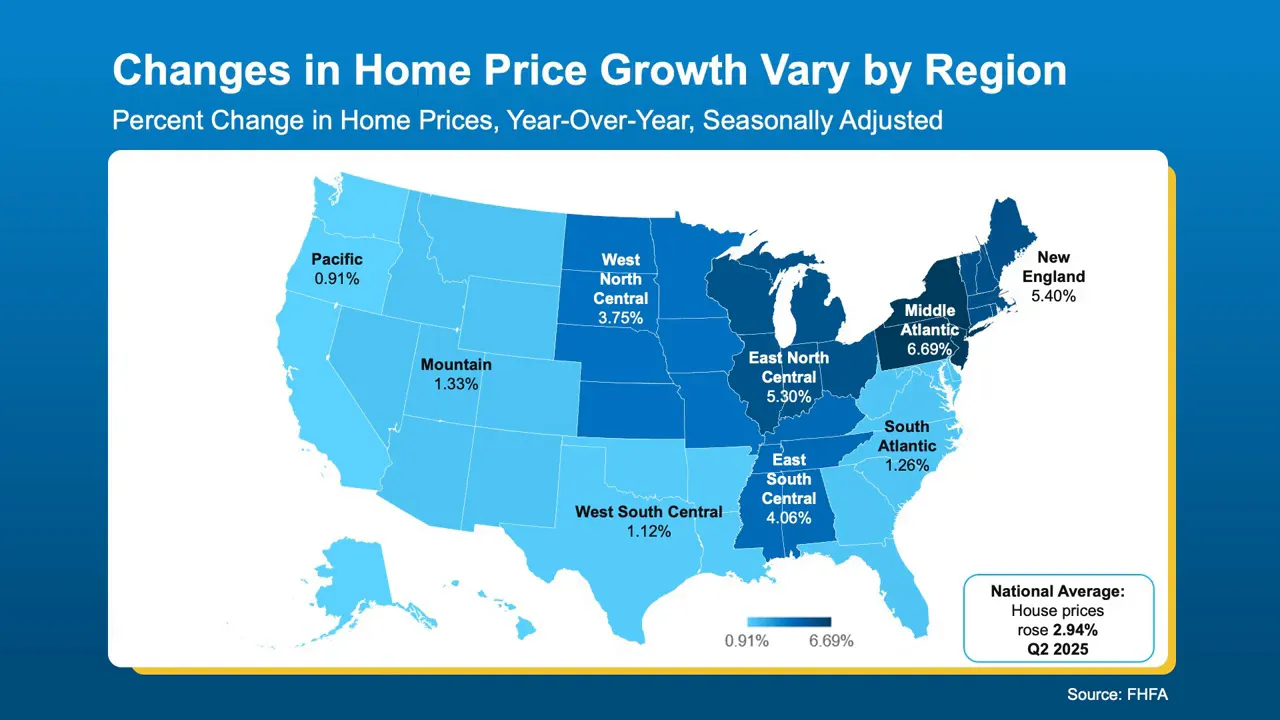

The update highlighted how different regions are behaving. Snowbelt states generally recorded slower growth than sunbelt or “sand” states. For Southwest Florida specifically, real estate dynamics are influenced by migration, seasonality, and local inventory.

Snapshot from the update:

- Year-over-year price growth varies widely by region; some northern markets are growing at around 3–4%, while parts of the Mid-Atlantic and many sunbelt areas are near 6%.

- The panel’s medium-term home price expectation (2025–2029) shows an average annual equity gain of roughly 4–4.5%—a healthy long-term return for homeowners.

Southwest Florida: Naples, Marco Island, Fort Myers, and Bonita Springs

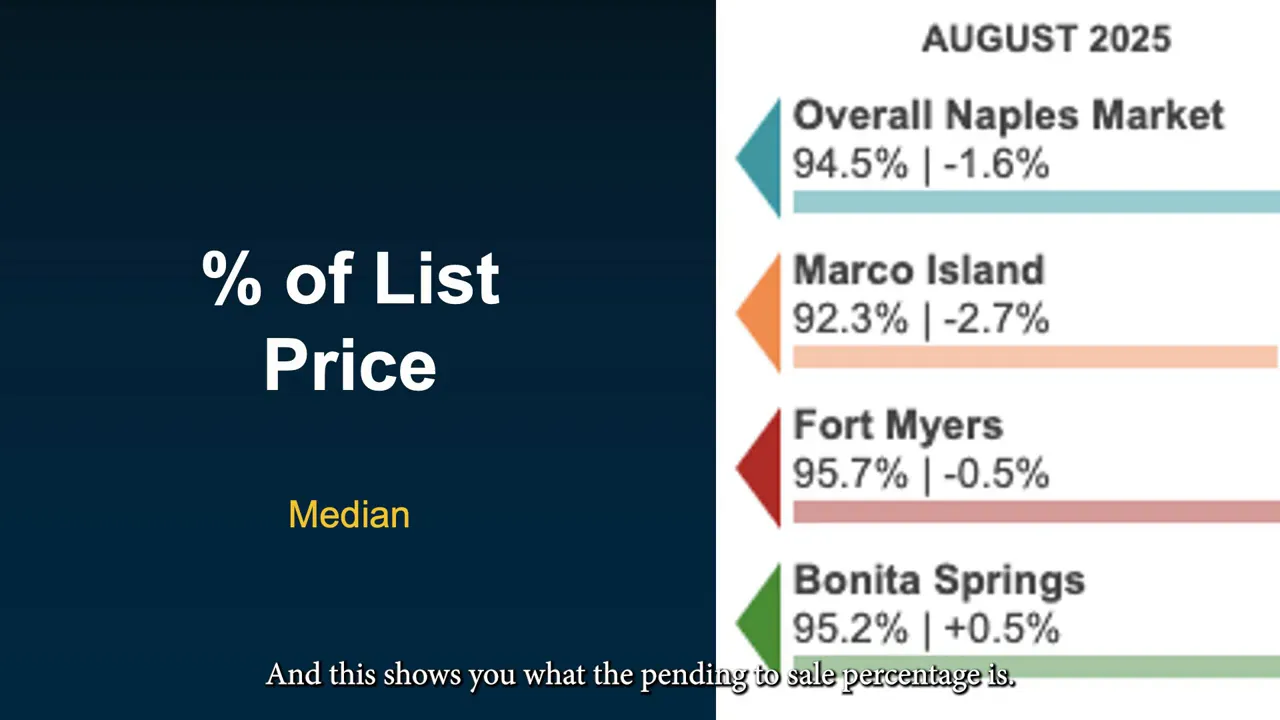

Local metrics matter more for sellers and buyers in Southwest Florida than national averages. This September Southwest Florida Market Update reviewed several local performance indicators:

- Pending-to-list price ratios: On Marco Island, the pending-to-list average was about 92.3%—meaning sellers typically accept offers around 7–8% below list on average, though correct pricing and quick sales can reduce that gap.

- Showings to pending: In Naples, it takes roughly 10.8 showings to obtain a pending contract; Marco averages about 11.5 showings, with Bonita closer to 10.4.

- Showings per listing: During August, most local markets averaged under three showings per listing, with Fort Myers at about 3.2—fewer showings than peak seasons in 2022–2023, but showing activity has increased year-over-year in some pockets.

These numbers underscore a buyer-leaning market in many price ranges. Sellers who price correctly, stage well, and market aggressively still get strong results; homes that linger often require price concessions.

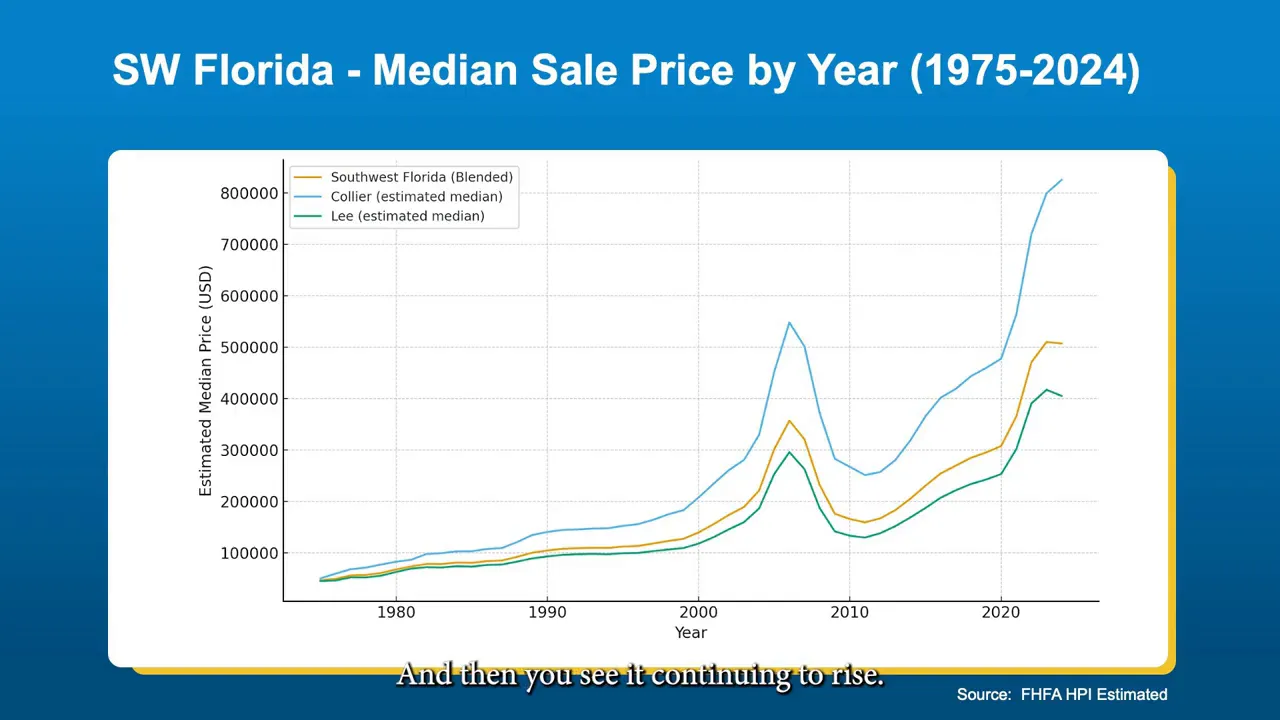

Long-Term Perspective: Cycles, Recoveries, and Equity

The panel reminded viewers that every downturn in housing history has ended in a recovery. Southwest Florida’s 50-year median sales price history mirrors national cycles: periods of decline followed by rebounds and long-term appreciation.

Equity remains a defining strength of the market. The corrected national homeowner equity figure referenced in the update is approximately $34 trillion—an immense pool of wealth. Locally, decades of price appreciation mean many homeowners hold substantial equity, which supports moves, refinances, and generational wealth transfer.

Is it time to move?

The presenters conclude this September Southwest Florida Market Update by answering the question many ask: “Is it a good time to move?” Their answer is a clear yes for many sellers and buyers. Reasons included:

- Affordability is beginning to return as rates moderate.

- Inventory has increased in seasonal markets, giving buyers more choices.

- Sellers with properties that have been on market for a long time can find motivated buyers and negotiate favorable terms.

Randy noted he has offered the lowest mortgage rates he’s seen in three years during the past month, and Mary emphasized that small pullbacks in price combined with improving rates create a “spark” that brings buyers back in. Seasonality will also push activity higher—more inventory plus slightly more competitive pricing is often the sweetest window to buy or upgrade.

Practical Advice for Buyers and Sellers in Southwest Florida

- Buyers: Get pre-approved, watch inventory weekly, and be ready to move quickly when a well-priced property appears. Consider locking a competitive mortgage rate if market movement suggests rising rates later this cycle.

- Sellers: Price strategically—overpricing leads to longer time on market and deeper discounts. Use professional photography and targeted marketing to maximize exposure in the buyer-leaning market.

- Both: Work with experienced local agents and lenders who understand how regional seasonality and migration patterns affect pricing and demand.

Conclusion

This September Southwest Florida Market Update makes three things clear: the Fed’s modest rate cut is important but not a direct one-to-one driver of mortgage rates; national prices have flattened rather than collapsed; and locally, opportunity exists for prepared buyers and sellers. With equity levels high and affordability beginning to rebound, the coming months could present one of the better windows to transact in Southwest Florida in recent years.

FAQ

Q: Will mortgage rates drop immediately after the Fed’s 25 basis point cut?

A: Not necessarily. Mortgage rates are influenced by the 10-year Treasury and overall market expectations. The cut may support lower consumer borrowing costs for short-term products, but mortgage rates often move based on bond market pricing and employment/inflation data.

Q: Are home prices falling in Southwest Florida?

A: No crash is evident. Prices have flattened in many markets, and local medians remain close to year-ago levels. Some neighborhoods and price points are more competitive—pricing correctly remains crucial.

Q: How much equity do homeowners hold nationally?

A: The update referenced a corrected national homeowner equity estimate around $34 trillion, illustrating the significant wealth tied up in residential real estate.

Q: How should sellers price their homes today?

A: Sellers should use comparable sales, adjust for market exposure, and listen to experienced local agents. Homes priced accurately and marketed aggressively continue to sell quickly and at favorable terms.

Q: Is now a good time to buy in Naples, Marco Island, Fort Myers, or Bonita?

A: For many buyers, yes. Improving affordability, increasing inventory during season, and competitive mortgage pricing for qualified borrowers create opportunities. Buyers should get pre-approved and be ready to act.

Q: Where can I get personalized advice for my situation?

A: Reach out to local experts—lenders and agents who know Southwest Florida seasonality and neighborhood-level dynamics—so you can build a strategy tailored to your goals.

For ongoing local insights and to dive deeper into neighborhood-level trends, the Bartos Group and its lending partners stand ready to help with tailored strategies for buying, selling, or refinancing in Southwest Florida.

Contact Us Today! |

|

Providing you the experience you deserve! |

| Click me |