The real estate market in Southwest Florida finished 2025 with clearer signals: affordability is improving, inventory is returning to normal levels, and buyers are in a stronger position than they were during the recent frenzy. Insights from local brokers Mary Bartos and mortgage professional Randy Williams reveal why buying now can still be a powerful long-term wealth strategy despite headlines that renting may be cheaper in some large metros.

Why Headlines Say Renting Looks Cheaper

National reports show that in many of the largest U.S. metros, the annual cost of renting is lower than the annual cost of owning when comparing cashflow alone. That comparison typically includes rent versus mortgage principal and interest, plus property taxes, insurance, maintenance, and repairs. Those numbers are useful, but they only tell part of the story about the real estate market.

The Equity Advantage: Why Ownership Still Matters

Equity accumulation changes the math. When home prices rise, equity gains reduce the effective annual cost of ownership. As Mark Fleming put it, “When the annual gain exceeds the ownership cost, the home effectively pays you to live there.” That concept explains why long-term homeowners often end up far better off than long-term renters.

The affordability gains are broad. Once you own, equity gains can offset a large share of your ongoing housing costs over time.

Mary and Randy point to historical examples: buyers who purchased a decade or more ago enjoy mortgage payments that look negligible today because the principal has been paid down and their home has appreciated. That equity can be used to finance moves, renovations, or additional investments without putting cash on the table.

Affordability is Improving — and So Is Opportunity

Multiple market trackers noted that affordability has improved month over month in most major markets. Lower mortgage rates compared to earlier highs and growing inventory give buyers more negotiating power. That combination can be especially impactful in the real estate market of Southwest Florida, where the local dynamics differ from national headlines.

Down Payment Realities

Randy emphasizes that a 20 percent down payment is not the only path into homeownership. Lending programs with 1 percent, 3.5 percent, or 5 percent down remain available through a variety of lenders. For many first-time buyers, these options are the practical route to start building equity in today’s real estate market.

Local Conditions: Inventory, Price Adjustments, and Seasonality

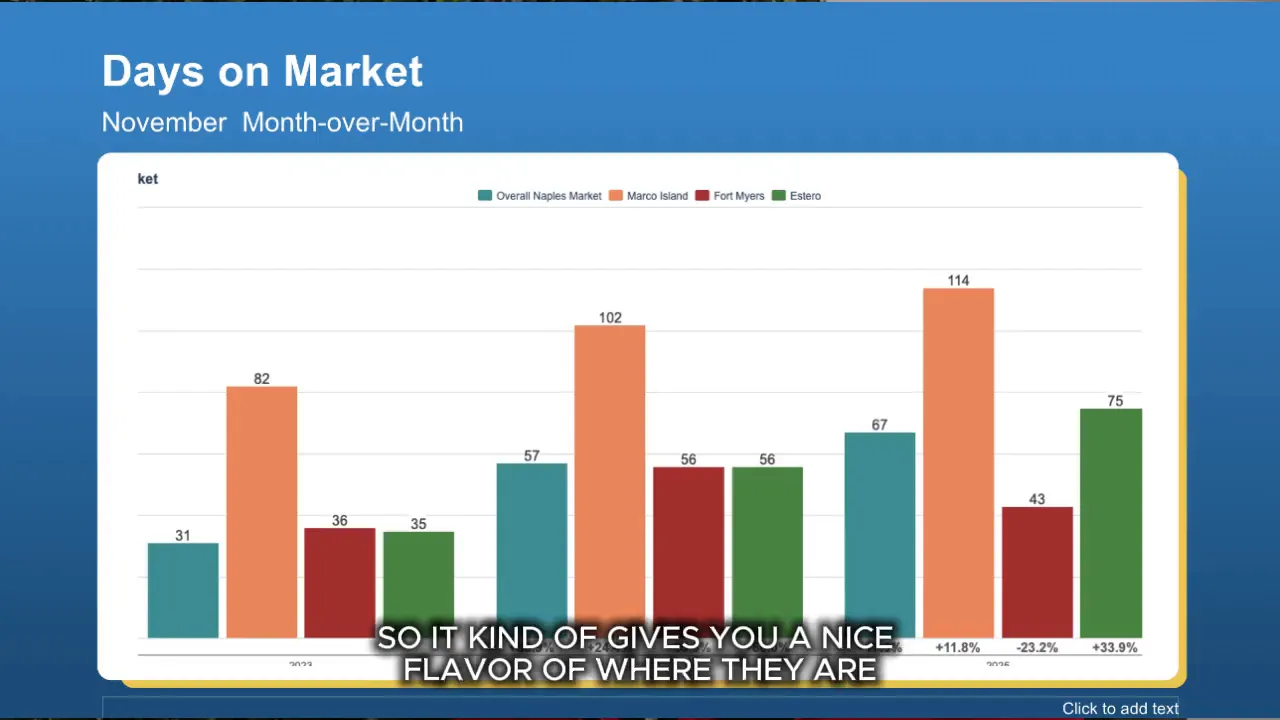

Realer.com and local observations show the number of actively listed homes rising and median days on market returning to pre-pandemic levels. That means buyers have more time to vet homes and make thoughtful decisions instead of scrambling in a bidding war. The normalization benefits both buyers and sellers who price their homes realistically.

Builders are responding to slower demand by offering incentives and price reductions. In November, a large share of builders reported cutting prices or offering sales incentives, sometimes in the form of construction credits or buyer concessions. For new-construction buyers, that can translate into real savings or upgraded finishes at little extra cost.

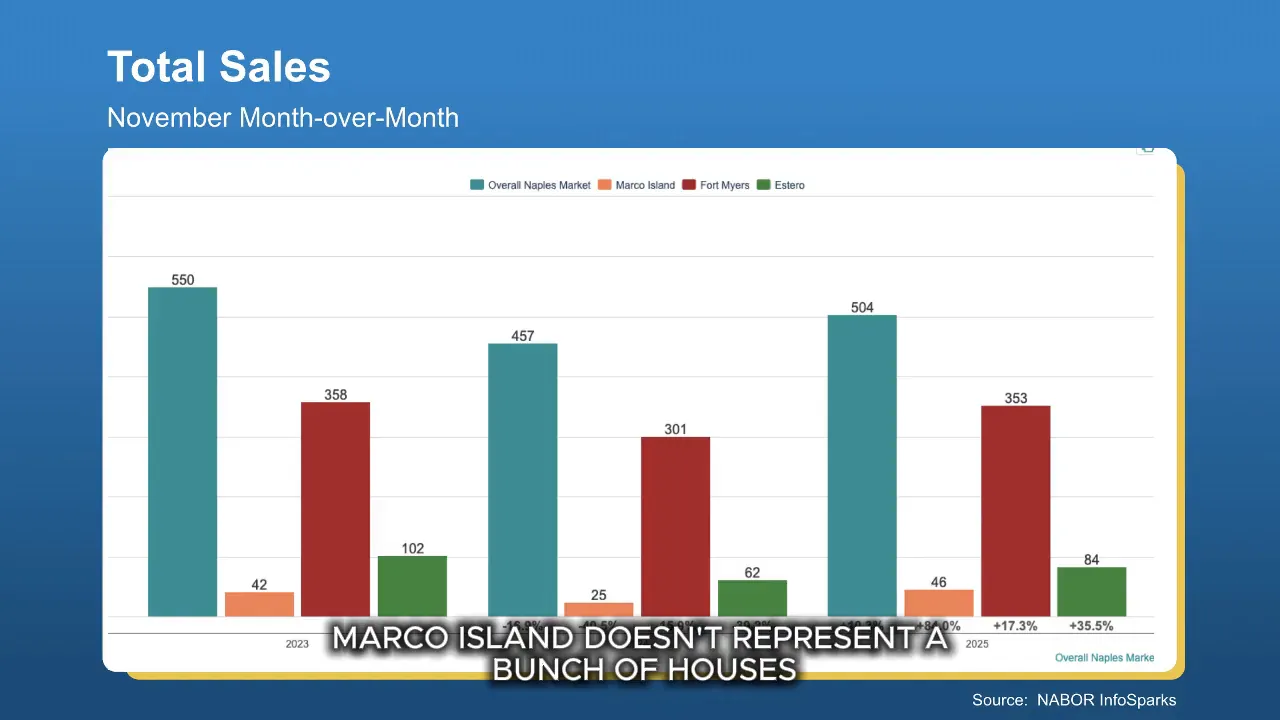

What the Local Numbers Reveal

Across Southwest Florida markets, median prices and sales activity vary by submarket and property type. Marco Island, Naples, Fort Myers, and Estero each tell a different story. For example, an uptick in condo sales on Marco Island drove a lower median price for the month even while overall sales climbed. That nuance underscores why local expertise is essential when interpreting broad real estate market statistics.

Practical Advice for Buyers

- Interview buyer agents: Choose a local agent with a proven track record who will act as an advocate and negotiate effectively. A good buyer agent provides market context, helps craft competitive offers, and protects buyers through closing.

- Consider locking a rate: Locking a mortgage rate protects against future rate spikes and lets buyers begin building equity immediately in the current real estate market.

- Evaluate incentives on new builds: Builders are offering concessions that can materially reduce cost or add value. Factor those offers into any comparison between resale and new construction.

- Think long term: Homeownership is a long-game investment. Over years and decades, equity gains and principal reduction have historically produced strong wealth outcomes relative to renting.

Practical Advice For Sellers

Sellers benefit from pricing a home correctly and focusing on marketing to attract the right buyer. In markets where median days on market have risen from the hyper-competitive lows, sellers who price aggressively may see multiple price cuts. Pricing to market and working with an agent who can position the property strategically reduces time on market and avoids repeated discounts.

How To Frame the opportunity

Mary emphasizes vision and patience. Local buyers who understand the long-term equity proposition are finding ways into ownership, including buying second homes or investment properties that leverage built-up equity. Randy highlights the financing toolbox: a network of lenders and creative programs make homeownership accessible even when headlines suggest renting is cheaper across major metros.

Key Takeaways

- The national comparison between renting and owning omits equity gains. Equity changes long-term economics.

- Affordability in many markets improved through 2025, shifting negotiation power to buyers.

- Inventory and days on market are returning to normal, giving buyers more time to decide.

- Builders are offering incentives and price reductions in many areas, creating openings for buyers of new homes.

- Local nuance matters. Submarket analysis—condos versus single-family homes—drives different outcomes.

Is now a good time to buy in the real estate market?

For buyers who are financially prepared, yes. Improving affordability, increased inventory, and incentives from builders create favorable conditions. Locking a mortgage rate and working with a strong local buyer agent help secure the advantages now.

How does equity affect the cost of owning versus renting?

Equity accumulation reduces the effective cost of ownership over time. When home values rise and mortgage principal decreases, the net cost of living in a home can be lower than renting, especially over a multi-year horizon.

Do buyers need 20 percent down to purchase?

No. Many lending programs allow for lower down payments, including options at 1 percent, 3.5 percent, and 5 percent. Buyers should consult mortgage professionals like Randy Williams to explore programs that fit their situation.

What should sellers do in a market with rising days on market?

Price competitively and invest in marketing. An honest, local agent will recommend realistic pricing and targeted promotion to reach motivated buyers without excessive listing time or price reductions.

How can homeowners use equity once it builds?

Homeowners can tap equity for down payments on another property, home improvements, or debt consolidation. Many local buyers use equity to move to different markets, buy second homes, or upgrade without large cash outlays.

Final thought

The real estate market in Southwest Florida is stabilizing in ways that favor informed buyers and disciplined sellers. With the right financing strategy from professionals such as Randy Williams and local market guidance from agents like Mary Bartos, homeownership remains a durable path to building wealth and achieving lifestyle goals.

Contact Us Today! |

|

Providing you the experience you deserve! |

| Click me |