Seller Concession in SWFL can be a game changer for buyers navigating affordability concerns in today’s market. In Southwest Florida, buyers have more leverage than they did during the recent seller-dominant years, and a well-crafted offer using seller concessions often delivers a lower monthly payment and an easier path to closing. This article explains the components of a strong offer, mortgage options that increase flexibility, practical examples of how concessions work, and negotiation tips to put more buying power back into the buyer’s hands.

Why Seller Concession in SWFL Matters Now

Market dynamics have shifted. After a period of multiple-offer situations where buyers waived contingencies and inspections to win deals, Southwest Florida buyers now enjoy far greater flexibility. That flexibility translates directly into opportunities to ask for seller concessions. Seller Concession in SWFL is not just a nicety; it is a strategic tool that can pay closing costs, fund escrow accounts, and even buy down an interest rate to lower monthly payments.

Five Components of a Winning Offer

Mary and Cheryl highlighted five core components that matter in a buyer market. Each component ties back to maximizing buyer affordability while keeping an offer attractive to sellers.

- Flexibility of the offer — timing, occupancy terms, and earnest money amounts can be negotiated to fit both parties.

- Inspections — buyers should get inspections and use findings as a negotiation point rather than waiving inspections out of fear of losing a bid.

- Terms — extended closings, post-occupancy, and preoccupancy arrangements can be used creatively to bridge needs.

- Mortgage options — different loan types, including nonQM and bridge solutions, open doors for buyers who do not fit conventional profiles.

- Price negotiations versus seller concessions — sometimes asking for concessions yields more monthly savings than pushing every dollar off the sales price.

Flexibility and Inspections

In the prior hot market, offers that waived inspections or mortgage contingencies were common. Today a buyer should get an inspection. Inspections provide a legitimate negotiation point: if the inspection identifies issues, the buyer can request repairs or a concession to address them. The new condo and flood disclosure forms also require clear disclosure of prior flooding, special assessments, and other risk factors. Those disclosures can materially affect insurance rates and must be considered in any offer.

Terms and Creative Occupancy

Longer contract terms, preoccupancy, and post-occupancy arrangements are back in play. If a property has been on the market for many months, sellers may accept a 60 or 90 day close or an extended occupancy period. These creative terms provide an edge: they let buyers secure the property they want while meeting the seller’s timing needs. Seller Concession in SWFL often pairs well with creative terms, giving both parties a flexible route to close.

Mortgage Options That Increase Buyer Flexibility

Not every buyer fits neatly into Fannie Mae or Freddie Mac boxes. For self-employed buyers, retirees living on fixed income, or buyers with nontraditional documentation, nonQM loans, bank statement loans, and bridge loans offer alternatives. Using these products wisely can be part of a strategy to use Seller Concession in SWFL effectively.

NonQM and Bank Statement Loans

NonQM, or non-qualifying mortgage, refers to loans that fall outside standard conforming guidelines. These loans can be structured around assets or bank statements instead of traditional W2 income. For a retiree with substantial retirement assets but minimal monthly income documentation, a nonQM loan based on asset qualification can make a purchase possible without tapping into retirement accounts.

Bridge Loans

A bridge loan can use the equity in a current home to fund the down payment on a new purchase. The lender determines payoffs, current value, and the feasible bridge amount. Typically, the bridge is repaid when the previous home sells and buyers may have up to 12 months to complete that sale. In a market where timing and liquidity can be obstacles, bridging equity can combine with seller concessions to make transactions flow smoothly.

Condos: Special Considerations

Condo purchases now require careful, early due diligence. New disclosure and documentation requirements create extra steps for buyers and lenders. The state allows a seven-business-day review of condo documents for buyers. That effectively becomes a nine-calendar-day window because weekends and holidays are excluded. Lenders must also review HOA documents to evaluate building eligibility for particular loan programs.

HOA responsiveness varies widely. Some associations are quick; others are self-managed and slow. For condos, a longer contract term may be necessary to ensure documents arrive in time for underwriting. Buyer Concession in SWFL combined with an extended contract can reduce the friction and allow a deal to close without rushed or unrealistic timelines.

Price Negotiation Versus Seller Concession: A Practical Example

Understanding when to ask for a price reduction and when to ask for a seller concession is essential. Consider this practical scenario used by Mary and Cheryl:

List price: 500,000 Negotiated price: 480,000 (buyer cuts 20,000 from list) Alternative approach: Offer a price closer to list and ask for a seller concession equal to 5 percent, which on a 500,000 purchase would be 25,000 back to the buyer.

Breaking the numbers down, a price reduction saves the buyer a small monthly amount spread over 30 years. A seller concession, used for closing costs, initial escrow deposits, first-year insurance, and buying down the rate, can produce a bigger monthly savings or cashflow relief at closing. For many buyers, Seller Concession in SWFL paired with a slightly higher purchase price creates a lower out-of-pocket need and a smaller monthly payment after buying down the interest rate even a quarter percent.

Why Seller Concession in SWFL Often Wins

Negotiating seller concessions is often the smarter financial move for buyers who want lower monthly payments or reduced cash needed at closing. Concessions fund the immediate items that determine monthly mortgage obligations and initial costs. A strategic concession can be turned into a rate buy down, which can result in a meaningful reduction in the monthly mortgage payment.

Don’t negotiate on the price. Get a seller concession.

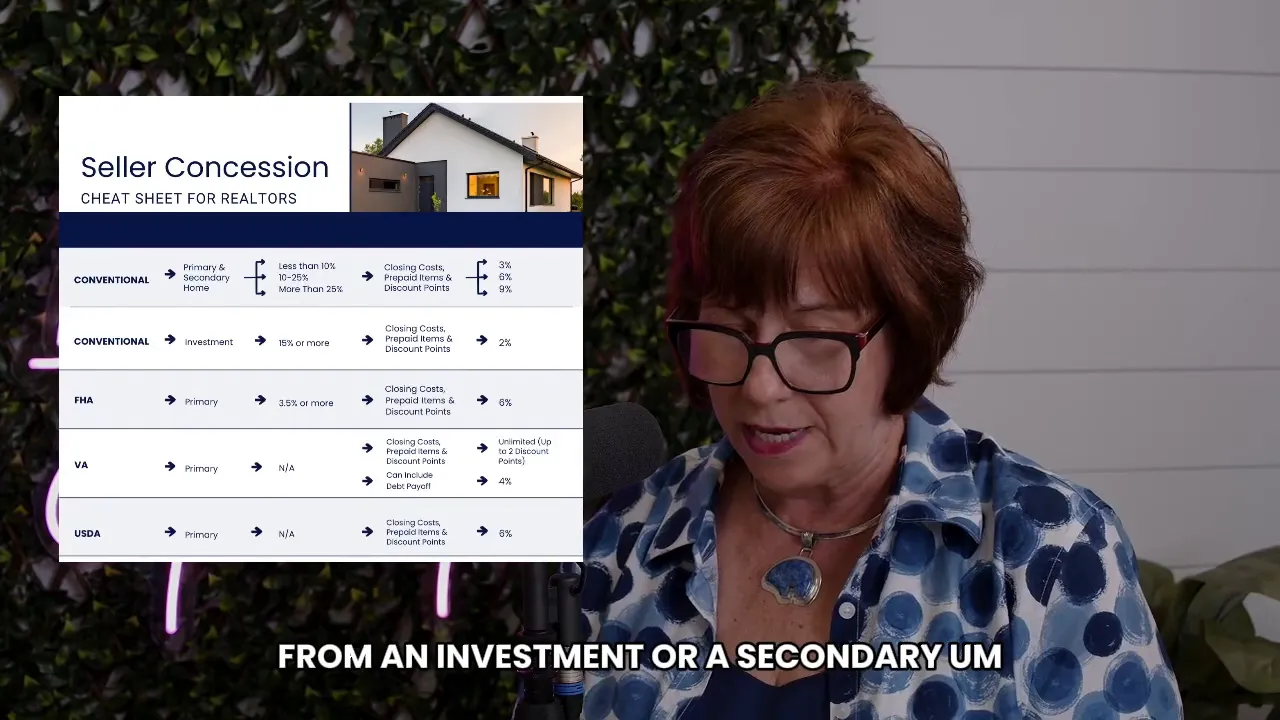

How Much Can a Seller Contribute?

Seller contribution limits depend on loan type and whether the property is a primary residence, secondary home, or investment property. Typical ranges are between 2 and 6 percent of the purchase price. Investors often can receive smaller concession percentages than owner-occupants, but even a 2 percent concession on an investment property can improve return on day one by reducing operating expenses or lowering finance costs.

Negotiation Tips for Buyers

- Always get an inspection and use findings as a negotiation tool rather than waiving the inspection to “win” a bid.

- Work with a lender familiar with SWFL condo associations and local HOAs so document requests and underwriting are efficient.

- Ask for seller concessions even if you qualify for a higher amount. Concessions help your monthly budget and may be easier for a seller to offer than a price drop.

- Consider creative terms like extended closing, preoccupancy, or post-occupancy if the seller values timing flexibility.

- Form a team with your buyer’s agent and lender to quantify impacts on monthly payments and cash-to-close so negotiation decisions are data-driven.

Download the Seller Concession Cheat Sheet

For an easy reference, use the Seller Concession cheat sheet linked below. It breaks down allowable concession percentages by loan type and property use and shows how to apply concessions toward closing costs, escrow, insurance, and rate buy downs.

Click Here To Download the PDF Cheat Sheet!

Final Takeaways on Seller Concession in SWFL

Seller Concession in SWFL is a practical lever buyers should use. When deployed correctly, concessions reduce cash needed at closing, free up funds to buy down interest rates, and improve monthly affordability. In a buyer market, negotiating concessions often provides more financial benefit than squeezing every dollar off the sales price. Buyers, agents, and lenders should collaborate to evaluate the true impact of concessions versus price changes and craft offers that meet financial goals and move deals to a clean closing.

Frequently Asked Questions

What is a seller concession and how does it affect my mortgage?

A seller concession is an agreement where the seller pays part of the buyer’s closing costs, escrow deposits, prepaid items, or rate buy down. It reduces the cash a buyer needs at closing and can be used to lower the monthly payment by funding an interest rate buy down.

How much can a seller contribute on a conventional loan?

Contribution limits vary by loan type and whether the property is a primary residence, secondary home, or investment. Typical contribution ranges are between 2 and 6 percent. The exact allowable amount depends on the loan program and down payment level.

Can I use seller concessions to buy down my interest rate?

Yes. Many buyers use concessions to purchase mortgage rate points, which lowers the interest rate and monthly payment. Even a quarter percent reduction in rate can change monthly payments by hundreds of dollars depending on loan size.

Are seller concessions available for condos in SWFL?

Yes, but condo purchases require additional documentation. Sellers may be motivated due to new condo rules, assessments, or flood disclosures, which can make concessions more likely. Buyers should allow extra time in the contract for HOA document retrieval and lender review.

Should I always ask for seller concessions instead of negotiating price?

Asking for concessions is often advantageous, especially if the buyer’s primary goal is monthly affordability or minimizing cash at closing. The best approach depends on the buyer’s goals, loan type, and seller motivation. Buyers should discuss scenarios with their lender and agent to decide.

Contact and Next Steps

Buyers in Southwest Florida who want to explore Seller Concession in SWFL are advised to assemble a local team: a knowledgeable buyer’s agent and a lender experienced with local HOA practices, condo documentation, nonQM options, and bridge loans. Use the cheat sheet linked above to guide initial conversations and request tailored calculations that show the monthly and cash-to-close impact of concessions versus price negotiations.

Contact Us Today! |

|

Providing you the experience you deserve! |

| Click me |